Unlocking Financial Wisdom: A Ceocolumn We Talk Money Guide For Smart Decisions

When we talk about money, it's often more than just numbers on a spreadsheet; it's about choices, opportunities, and the future. Here in our ceocolumn we talk money, we aim to peel back the layers of financial strategy, offering insights that can truly make a difference for individuals and businesses alike. You know, it's really about understanding the flow, the currents, and how to steer your financial ship effectively.

For many, discussing finances can feel a bit daunting, yet it's a conversation that holds immense value. Whether you're a business leader looking to boost your bottom line or someone simply wanting to manage your personal funds with more skill, the principles often overlap. We see this, for instance, in how a business might streamline its operations, very much like how you might tidy up your personal budget, more or less.

This article aims to shed some light on key money matters, offering a fresh look at how financial savvy can lead to greater stability and growth. We'll explore ideas from making smart business choices to handling your personal spending, all with a practical, down-to-earth approach. So, let's get into it, shall we?

- Dallas Cowboys Owner

- Bra To Wear With Strapless Dress

- Will Ferrell Kids

- Christopher Walken Pennies From Heaven

- Freddie Wong Age

Table of Contents

- The CEO Mindset on Money

- Making Smart Business Decisions

- Personal Finance Insights for Everyone

- Adapting to Market Changes and Regulations

- Frequently Asked Questions About Money Matters

- Putting It All Together: Your Financial Next Steps

The CEO Mindset on Money

When you're running a company, the way you think about money changes a bit. It's not just about what you have in your wallet; it's about resources, investments, and the long-term health of an entire operation. A good leader, you know, sees money as a tool for growth, not just something to accumulate. They're always looking at the bigger picture, trying to figure out how each financial choice impacts the whole system, as a matter of fact.

This perspective means looking beyond immediate gains and considering sustainability. It's about setting up systems that keep the money flowing and working for the business, much like how a well-organized computer system keeps things running smoothly. You might think about it like clearing out old, unnecessary files from your computer, like those NVIDIA driver remnants or other temporary items that just take up space. In a way, you're always trying to keep things lean and efficient.

Strategic Financial Planning

For any business, big or small, having a clear financial plan is pretty important. This isn't just about making a budget; it's about mapping out where you want to go and how money will help you get there. It involves setting goals, figuring out what resources you'll need, and then making smart choices about how to use them. For example, a company might decide to invest in new technology, or perhaps expand into a different market, which, you know, requires careful financial foresight.

This kind of planning also means anticipating challenges. Just like how new regulations for electric vehicles came into play in 2020, impacting consumer choices, businesses also face changing rules and market conditions. A strategic plan helps you prepare for these shifts, allowing you to adjust your course without getting completely derailed. It's about being nimble, really, and ready for whatever comes your way.

Understanding Cash Flow and Operational Efficiency

Cash flow is, quite simply, the lifeblood of any business. It's the money coming in and going out, and keeping a close watch on it is absolutely vital. A healthy cash flow means you can pay your bills, invest in growth, and handle unexpected costs without too much stress. It's like having a steady stream of water for your garden; without it, things just don't grow, you know?

Improving operational efficiency is a direct way to boost cash flow. This means finding ways to do things better, faster, and with less waste. Think about it like tidying up your computer's C drive, getting rid of those hidden AppData files that hog space and slow things down. By cutting out unnecessary steps or expenses, you free up resources that can then be put to better use, which is pretty significant for the bottom line.

Making Smart Business Decisions

Every decision a business leader makes has a financial ripple effect. From choosing suppliers to designing products, money is always a key part of the equation. It's not just about saving a buck; it's about getting the most value for every dollar spent and making sure your operations are as effective as they can be. This is where, like, really digging into the details can pay off.

Consider how different tools can help you manage things. Just as a powerful download tool like "Quick Bird Download" helps you get resources efficiently, businesses also need tools and strategies to manage their financial resources. It's about having the right systems in place to make informed choices, which, honestly, makes a huge difference.

The Role of DFM in Cost Control

DFM, or Design for Manufacture, is a concept that's pretty central to saving money in production. It means thinking about how something will be made right from the very start, during the design phase. By considering the manufacturing process early on, companies can avoid costly mistakes, reduce material waste, and streamline assembly. It's a way of making sure that what you design can actually be produced efficiently and affordably, which, you know, makes a lot of sense.

This approach helps businesses create products that are not only good quality but also cost-effective to produce. It's about optimizing the entire system, much like how you might organize your game save files into a neat folder in "My Documents" to easily find them later. A well-designed product, in this context, is one that's designed with its eventual manufacturing cost in mind, which is a rather smart way to approach things.

Choosing the Right Business Model: OEM vs. ODM

When it comes to bringing products to market, businesses often face a choice between OEM (Original Equipment Manufacturer) and ODM (Original Design Manufacturer) models. Each has its own financial implications and strategic advantages. OEM typically means you design the product, and another company builds it to your specifications. ODM means you're buying a product that another company has already designed, and you just put your brand on it. This choice, you know, impacts everything from development costs to intellectual property.

Understanding the differences between these models is pretty important for cost management and market positioning. For a smaller company, an ODM approach might save a lot on research and development, allowing them to get a product out faster. For a larger company, OEM might give them more control over the product's unique features. It's about finding the right fit for your budget and your business goals, which, you know, can be quite a strategic decision.

Personal Finance Insights for Everyone

While we often talk about money from a CEO's perspective, many of the same principles apply to personal finances. Managing your own money effectively means understanding where it comes from, where it goes, and how to make it work harder for you. It's about making smart choices every day, and, you know, building a secure financial future for yourself.

Just as a company needs to track its expenses, individuals also benefit from knowing exactly where their money is going. This can involve setting up a budget, tracking spending, and looking for ways to save. It's not always easy, but it's pretty rewarding when you see your financial picture getting clearer, in a way.

Managing Your Digital Financial Footprint

In today's world, a lot of our financial activity happens online. From banking apps to online shopping, our digital footprint is growing. Managing this footprint means keeping your financial information secure and organized. It's like having a clean digital workspace, where everything is easy to find and protected, which is, frankly, super important.

Think about how you use tools like WhatsApp Web for messaging. It's convenient and accessible from your desktop, allowing you to send and receive messages and files with ease, all for free. Similarly, there are digital tools for managing your money that offer convenience, but it's always good to be mindful of security. Keeping your financial data tidy, much like clearing out old files from your computer's AppData directory to prevent your C drive from turning red, helps keep your financial life in order, too it's almost a digital decluttering.

Accessing and Using Financial Tools

Getting access to the right financial tools can really simplify money management. Whether it's a budgeting app, an investment platform, or a specific type of payment card, these tools are designed to make your financial life easier. For instance, getting a VISA card for overseas spending, as some folks found, can be a bit tricky with certain top-up methods, but finding a simpler way makes a huge difference. You know, it's about finding what works for you.

The key is to use these tools effectively and to understand how they fit into your overall financial plan. Just like you might change the default font in Word from Cambria Math to something else to make your document look just right, you might also need to adjust how you use financial tools to better suit your needs. It's about making them work for you, not the other way around, you know, which is pretty sensible.

Adapting to Market Changes and Regulations

The financial world is always moving, and staying informed about market changes and new regulations is pretty important for both businesses and individuals. Things like new national standards for electric vehicles can change how people buy cars, and similar shifts happen across all industries. Being aware of these changes allows you to adapt your financial strategies and make informed decisions, which is, honestly, a big part of staying ahead.

For businesses, this might mean adjusting production lines or marketing strategies. For individuals, it could mean re-evaluating investment choices or spending habits. It's about being flexible and ready to pivot when circumstances change. You know, it's a bit like keeping an eye on the weather forecast; you wouldn't go out in a storm unprepared, would you?

Understanding these broader economic shifts can help you make better long-term plans. For instance, if there's a trend towards more sustainable products, businesses that adapt early might find new opportunities. Similarly, individuals who understand economic trends might make smarter investment choices. It's all about foresight, really, and being proactive rather than reactive, which, you know, tends to work out better.

Frequently Asked Questions About Money Matters

People often have similar questions when it comes to money, whether it's for a big company or just for themselves. Here are a few common ones:

How do CEOs make financial decisions?

CEOs typically base financial decisions on a mix of strategic goals, market analysis, and risk assessment. They look at long-term growth, operational efficiency, and how to best allocate resources to achieve their vision. They also consider current economic conditions and potential future trends, which, you know, takes a lot of careful thought. It's not just about what's profitable right now, but what will keep the business healthy for years to come, so.What are common money mistakes businesses make?

Some common mistakes businesses make include not managing cash flow well, overspending on non-essential items, failing to plan for unexpected costs, and not adapting to market changes quickly enough. They might also neglect to regularly review their financial performance or rely too heavily on a single revenue stream, which, you know, can be a bit risky. It's about balance, really, and keeping a close eye on the details.How can a business improve its cash flow?

To improve cash flow, a business can focus on things like speeding up accounts receivable (getting paid faster), managing inventory more efficiently, negotiating better terms with suppliers, and reducing unnecessary expenses. They might also explore new revenue streams or optimize their pricing strategies. It's about making sure money comes in faster than it goes out, which, you know, is pretty fundamental to staying afloat.

Putting It All Together: Your Financial Next Steps

As we've explored in this ceocolumn we talk money discussion, managing money well, whether for a business or your own life, comes down to a few key ideas: smart planning, efficiency, and being ready for change. It's about looking at your resources, making informed choices, and always seeking ways to improve. Just like you might clean up your computer to make it run faster, tidying up your financial habits can lead to much smoother operations, too it's almost a universal truth.

We encourage you to take these insights and apply them to your own situation. Perhaps you'll start by looking at your own "DFM" for daily spending, optimizing how you allocate your personal funds. Or maybe you'll consider the "OEM vs. ODM" of your career choices, weighing different paths for financial growth. There's always something to learn, always a way to get a bit better at handling your money, you know.

For more detailed insights on financial strategy, you might find valuable information on a reputable financial news site, like this one: Reuters Finance. You can also learn more about our financial insights on our site, and link to this page our resources for additional help.

- Darnell Nicole And Darnell Dockett

- Jabuuti Wasmo Telegram

- Who Is Al Greens Current Wife

- Can You Use Oil As A Heat Protectant

- Who Is Freddie Highmores Twin Brother

WE-Talk-Money Logo - Robert Gignac

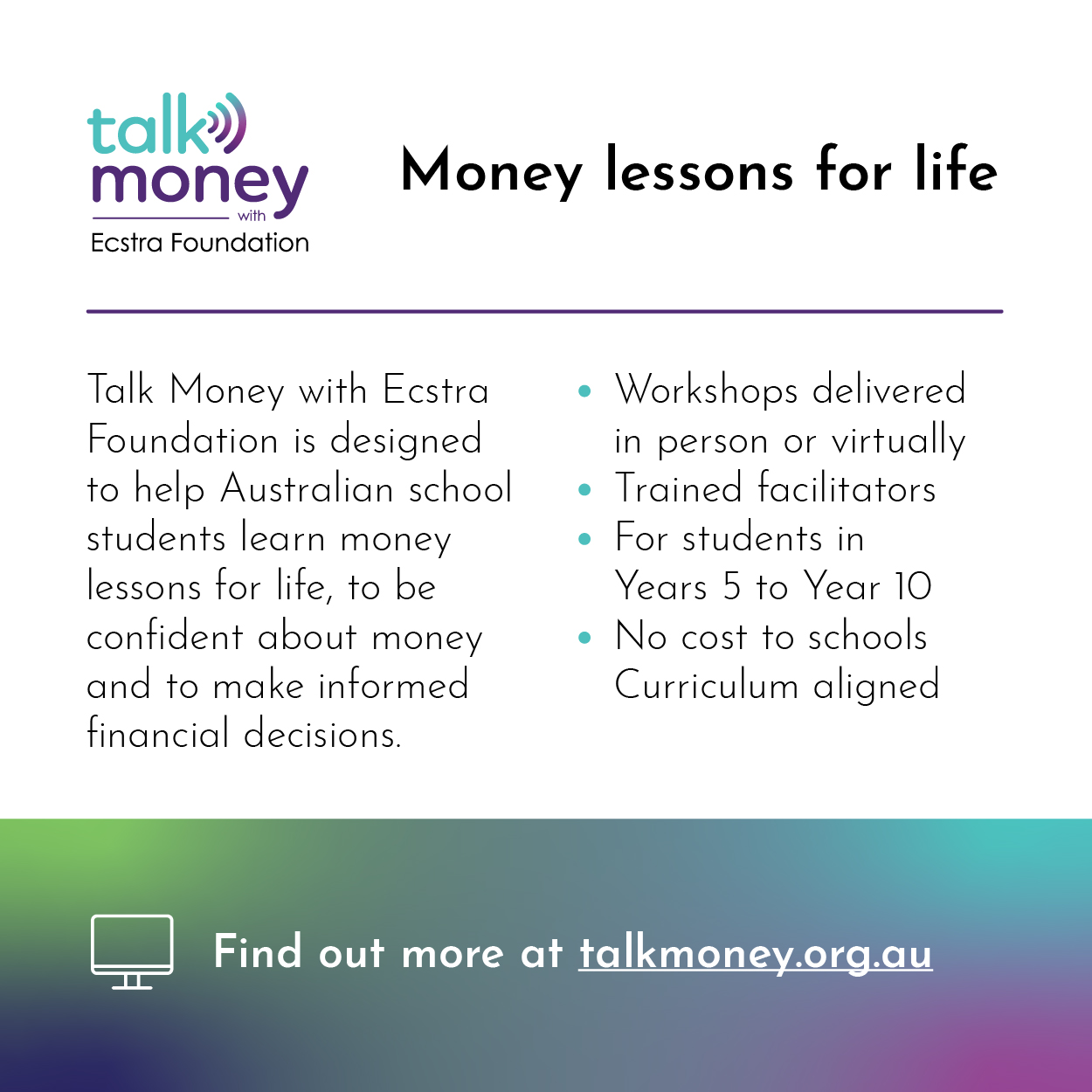

Community - Talk Money with Ecstra Foundation

Community - Talk Money with Ecstra Foundation