How Did Damon Darling Get Rich? Exploring Paths To Financial Success

So, you might be wondering, how did Damon Darling get rich? It's a question many people ask, especially when someone's financial standing appears to change quite a bit. People are often curious about the paths others take to build considerable wealth. This interest, you know, really sparks a lot of discussion about how success happens.

Figuring out the exact details of someone's financial climb can be, well, a bit like trying to solve a puzzle with missing pieces. Public figures, or even those who gain significant wealth, often keep their financial strategies private for various reasons. That said, we can still look at common ways individuals tend to accumulate substantial assets and see how those might apply to a person like Damon Darling.

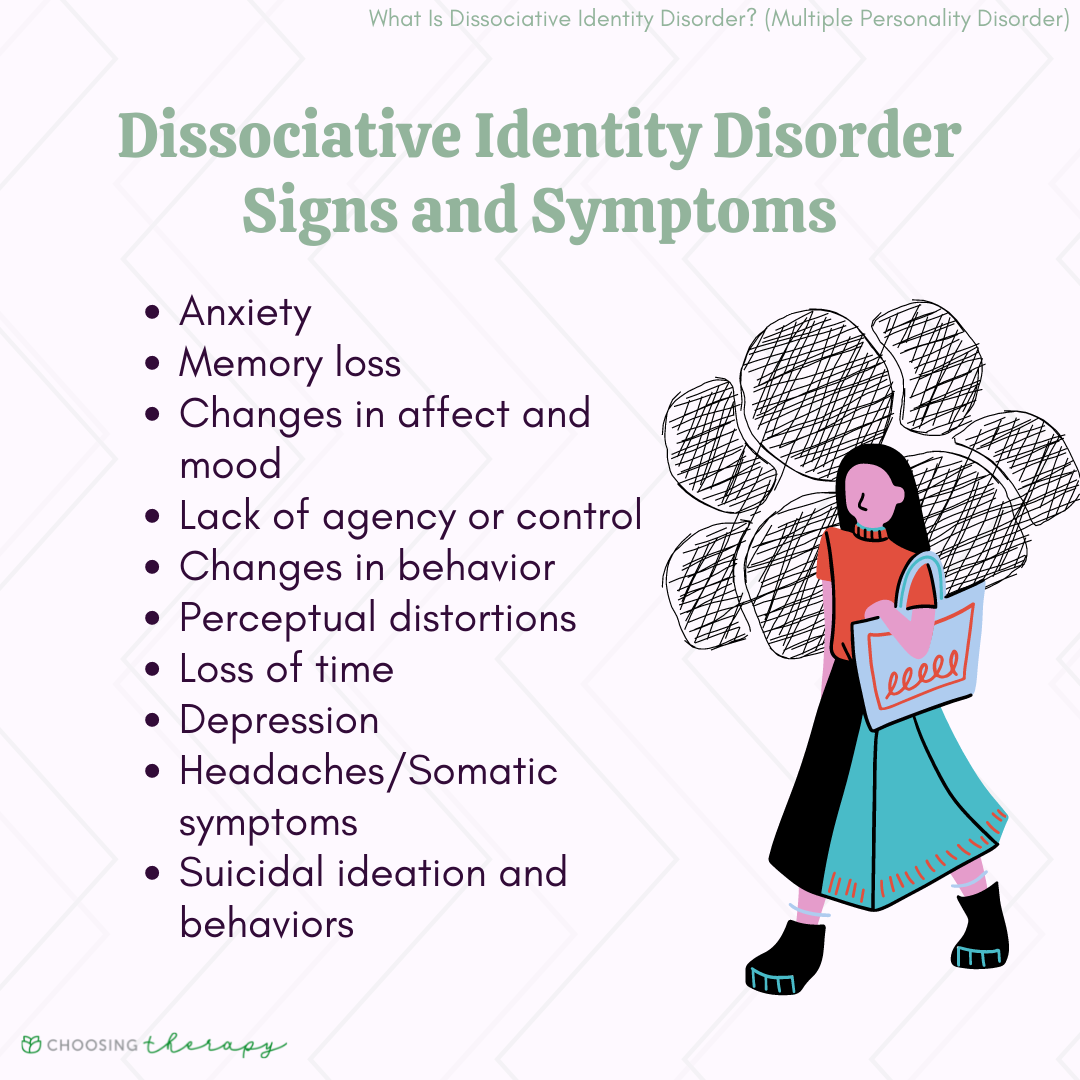

This article aims to explore the general routes to financial success, offering some insights into what might be behind a person's wealth. We will also touch on why specific information about someone's money matters can be hard to find, and perhaps, how some things are just not as straightforward as they seem, a bit like how dissociative identity disorder (DID) is often misunderstood and portrayed incorrectly.

- Alice Delish

- How Many Kids Did Ozzy

- When Did John Kennedy Jr Die

- Mitzi Shore Net Worth

- How Much Money Did Anderson Cooper Inherit From His Mother

Table of Contents

- Who Is Damon Darling? A Look at Public Information

- Unpacking the Mystery: Common Routes to Wealth

- The Information Gap: Why Wealth Paths Are Often Private

- People Also Ask About Wealth Building

- Your Path to Financial Well-being

Who Is Damon Darling? A Look at Public Information

When someone's name comes up in discussions about wealth, it's pretty natural to want to know more about them. Damon Darling, as a name, often sparks this kind of curiosity. People want to understand the person behind the perceived fortune. It's really just human nature to be interested in success stories.

However, it's important to remember that not all information about individuals, especially their financial specifics, is readily available in the public domain. This is often the case for many people who achieve a certain level of financial comfort. Public records might show some business registrations or property dealings, but a complete picture of their net worth or income streams is usually kept private. You know, for privacy reasons.

Personal Details and Public Bio

Regarding Damon Darling, specific, verified public biographical details related to a significant accumulation of wealth are not widely published as of late 2023. This makes it a bit tricky to pinpoint an exact origin story for any substantial financial standing. So, we're operating a little bit on general principles here.

- Michelle Hurd Net Worth

- Mark Paul Baseball Net Worth

- Emily Wilson Political Commentator

- Oishii Desu

- Kat Dennings Fappening

Here’s what we might typically look for in a public bio for someone like Damon Darling, if such information were widely shared:

| Category | Potential Information (If Available) |

|---|---|

| Full Name | Damon Darling |

| Date of Birth | Often not publicly disclosed for private individuals. |

| Place of Birth | Similarly, often not public unless relevant to a public role. |

| Education | Could include degrees, institutions, or specialized training. |

| Known Ventures | Any businesses founded, major investments, or public projects. |

| Public Recognition | Awards, philanthropic efforts, or media mentions. |

Without specific, confirmed details, any discussion about Damon Darling's wealth remains, in a way, more about the general pathways to financial success than about a specific individual's confirmed history. That's just how it is sometimes with private financial matters.

Unpacking the Mystery: Common Routes to Wealth

Since concrete information about Damon Darling's exact financial journey is not publicly detailed, we can, as a matter of fact, explore the most common and effective strategies people use to build significant wealth. These are the routes that often lead to someone being described as "rich." They tend to involve a mix of hard work, smart choices, and sometimes, a bit of good fortune.

Entrepreneurship and Business Ventures

One of the most direct ways people get rich is by starting and growing their own businesses. This path involves creating something new, whether it's a product, a service, or a fresh way of doing things. You see, an entrepreneur identifies a need in the market and then works to fill it, often taking considerable risks along the way. This could be anything from a tech startup that changes how we communicate to a local business that scales up to serve a wider area.

For someone like Damon Darling, this might mean they developed a unique software, launched a successful chain of stores, or perhaps even innovated in a niche industry. The key here is usually scalability; a business that can serve many customers or grow quickly often leads to significant financial returns. So, it's about building something that can really take off.

Building a successful business also often means assembling a great team, making smart operational decisions, and adapting to market changes. It’s a bit like nurturing a plant; you have to give it the right conditions, prune it, and help it grow. This path demands a lot of effort and a clear vision, but the rewards, frankly, can be substantial.

Strategic Investments and Financial Acumen

Another powerful way people accumulate wealth is through smart investing. This isn't just about putting money into a savings account; it involves making informed decisions about where to place capital to generate returns over time. This could mean investing in stocks, bonds, real estate, or even other businesses. A person with strong financial acumen often understands market trends, assesses risk, and makes long-term plans.

For Damon Darling, this could mean they made early investments in promising companies, perhaps in the tech sector or renewable energy, that saw significant growth. Or, they might have built a substantial real estate portfolio, buying properties that appreciated in value or generated steady rental income. It's pretty much about making your money work for you, rather than just working for your money.

Successful investing often requires patience and discipline. It means not panicking during market downturns and sticking to a well-thought-out strategy. You know, it’s about understanding compound interest and letting time do its work. This approach, honestly, can turn modest sums into very large ones over decades.

Leveraging Unique Skills or Talents

Sometimes, wealth comes from possessing a very specific or highly valued skill set. This could be in a professional field, like a top surgeon or a renowned lawyer, or in creative fields, such as an artist, musician, or writer whose work resonates widely. People who are exceptionally good at something that is in high demand can command very high fees or royalties.

If Damon Darling gained wealth this way, they might be an innovator in a particular scientific field, a sought-after consultant with specialized knowledge, or perhaps someone who created a hugely popular piece of content or intellectual property. This path often involves years of dedication to honing a craft or accumulating expertise. It's about being really, really good at something unique.

This also extends to leadership and management skills. Someone who can effectively lead large organizations or manage complex projects can be highly compensated. So, it's not just about what you know, but also what you can do with that knowledge and how you can influence others.

The Role of Luck and Timing

While hard work and smart decisions are clearly vital, it's also true that luck and timing can play a significant part in someone becoming rich. Being in the right place at the right time, or having an idea just as the market is ready for it, can sometimes accelerate wealth accumulation dramatically. This isn't to say success is purely random, but rather that external factors can give a considerable boost.

For example, someone might have started a business just before a boom in their industry, or invested in a stock right before it soared due to unforeseen circumstances. These elements, you know, are outside of direct control but can certainly influence the speed and scale of financial gain. It's a bit like catching a wave at just the perfect moment.

This aspect highlights that while we can control our efforts and choices, some elements of financial success remain, in a way, outside our direct influence. It's a reminder that even the most well-laid plans can benefit from a little bit of good fortune.

The Information Gap: Why Wealth Paths Are Often Private

It's interesting, really, how much curiosity there is about how people get rich, yet how little concrete information is often available. The path to wealth for many individuals, including someone like Damon Darling, is frequently kept out of the public eye. There are several good reasons for this, and it’s a situation that, you know, is quite common.

For one, privacy is a major concern. People with significant wealth often prefer to keep their financial details confidential to avoid unwanted attention, potential security risks, or even just the burden of public scrutiny. It's a personal choice, and it's something many people would probably do if they were in a similar position. That's just how it goes, sometimes.

Furthermore, the structure of wealth can be quite complex. It might involve a mix of private equity, trusts, various business entities, and international investments. Untangling all of that for public consumption is, quite frankly, a massive task, and often not something that's legally required unless they hold a public office or are involved in specific regulated industries. Just like certain mental health conditions, such as dissociative identity disorder (DID), are often misunderstood and portrayed incorrectly in media, the intricate financial structures of the wealthy can also be quite complex and not easily summarized or understood from the outside. DID, as Psychology Today points out, is a rare condition where two or more distinct identities control behavior, and its complexity can be a bit like trying to trace every single financial thread someone might have.

Also, the information we do see about someone's wealth is often a snapshot, not a continuous stream. Net worth can fluctuate greatly depending on market conditions, business performance, and personal financial decisions. So, even if some information were public, it would likely be outdated quickly. It's not a static thing, by any means.

This information gap means that when we ask "how did Damon Darling get rich," we're often left to speculate based on general economic principles and common success stories, rather than specific, confirmed facts. It's a bit like trying to piece together a story from just a few scattered clues. You can make educated guesses, but the full narrative might remain a mystery.

People Also Ask About Wealth Building

When people are curious about how someone like Damon Darling got rich, they often have broader questions about wealth and success. Here are some common ones that come up:

1. Is it possible to get rich quickly?

While some stories of rapid wealth accumulation exist, often through things like lottery wins, successful startups, or sudden market surges, most substantial wealth is built over time. It typically involves consistent effort, smart decisions, and patience. Quick wealth is, you know, relatively rare and often comes with its own set of challenges. Very few people become rich overnight without some kind of existing foundation or a truly unique, timely opportunity.

2. What are the best industries to get rich in today?

There isn't one single "best" industry, as opportunities change. However, sectors experiencing rapid growth or significant innovation often present strong chances. This includes technology, renewable energy, biotechnology, and specialized digital services. But really, success can be found in any industry if you offer something valuable and execute well. It's more about solving problems effectively than just picking a trendy field.

3. How much money do you need to start building wealth?

You don't need a huge sum to begin. Many people start with small, consistent investments. The power of compound interest means that even modest amounts, invested regularly over a long period, can grow significantly. The most important thing is, basically, to start saving and investing as early as you can, and to be consistent with it. It's not about the starting amount as much as the habit.

Your Path to Financial Well-being

While the exact details of how Damon Darling got rich remain, in a way, private, the principles behind building wealth are pretty universal. Whether it's through starting a business, making smart investments, or leveraging unique talents, the core elements often involve vision, hard work, and persistent learning. It's a journey that typically requires a lot of dedication and a willingness to adapt.

For those looking to improve their own financial standing, focusing on these fundamental principles is a solid approach. Consider learning more about personal finance strategies on our site, and perhaps explore this page about entrepreneurial ventures. Understanding how money works and making deliberate choices can set you on a good path, honestly, no matter where you're starting from. It's about taking control of your financial future, one step at a time, today, November 27, 2023.

- Sébastien Auzière Age

- Nagi Hikaru Similar

- One Wild Moment Ending Explained

- Who Is Caitlin Clark Dating

- Songs For Daughter

Prevention Of Dissociative Identity Disorder

Arnold Schwarzenegger: Is He Still Alive? Debunking Death Hoaxes

DID vs DO vs DONE 🤔 | What's the difference? | Learn with examples