Did England Ever Use Euros? Unpacking Britain's Currency Choice

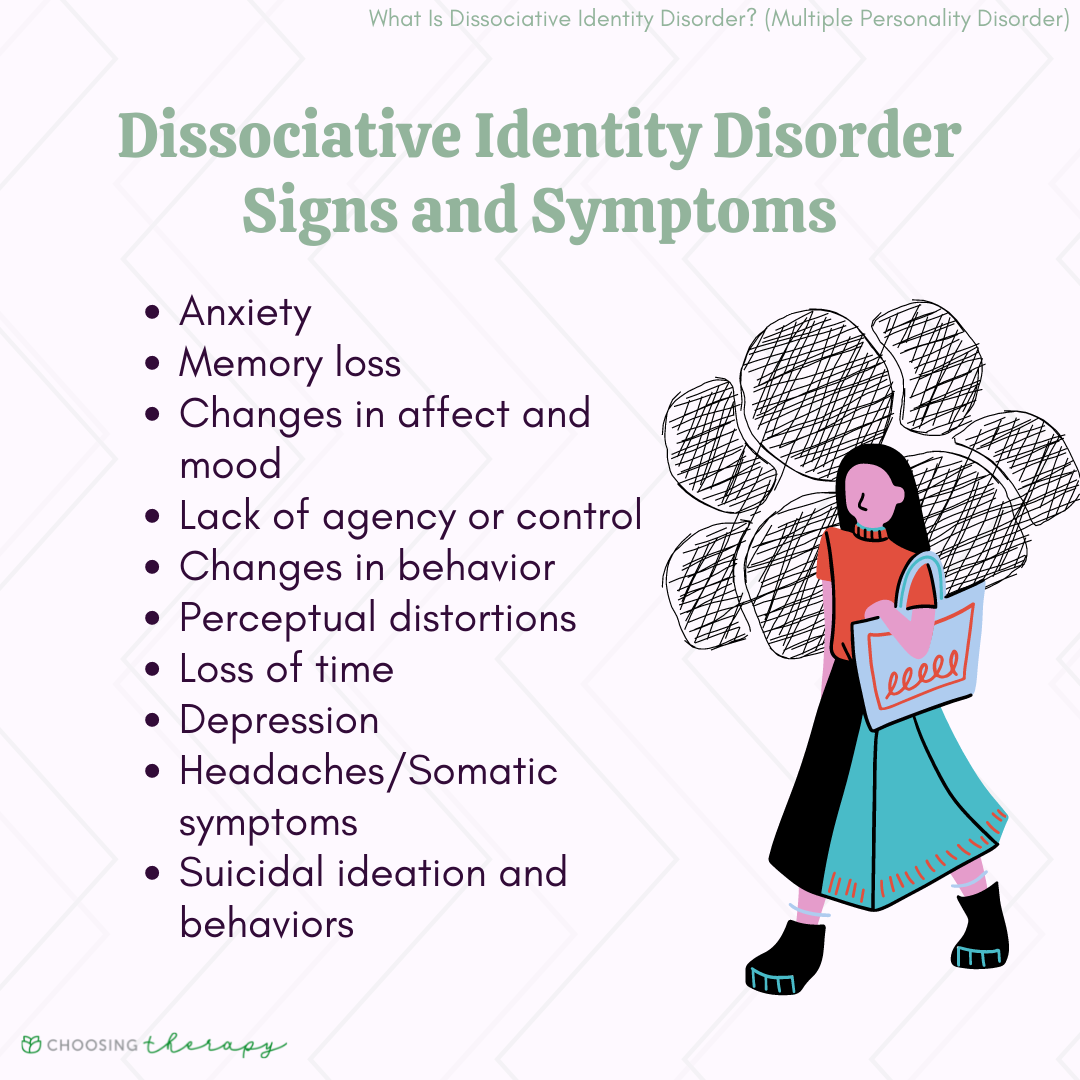

When you type something like "did England ever use euros" into a search bar, it's quite natural for your mind to consider what the word "did" truly means here. For some, "DID" might bring to mind a different kind of subject entirely, perhaps even those discussions about unique ways individuals experience their inner world, a topic that, you know, is often misunderstood and sometimes comes with a lot of stigma. But here, we're talking about something very different: the past actions of a country and its money.

This common query about England's currency choice touches on a really interesting part of recent history. It brings up questions about national identity, economic independence, and what it means for a country to choose its own path in a big, connected world. So, as a matter of fact, let's talk about money, specifically England's money, and its connection, or lack thereof, to the Euro.

The answer to "did England ever use euros" is pretty straightforward, but the story behind it is rich with details and important decisions. It's a tale that involves economic theories, political debates, and the feelings of ordinary people. We'll explore why England, or rather the United Kingdom, never adopted the Euro, and what that choice means even now, in some respects.

Table of Contents

- The Pound Sterling: A Long History

- Britain's Path to Europe and the Opt-Out

- Economic Arguments For and Against Joining the Euro

- The Role of Public Opinion and Political Will

- What Currency Does England Use Today?

- Frequently Asked Questions About England and the Euro

- Where Britain Stands on Currency Today

The Pound Sterling: A Long History

The money England uses, the Pound Sterling, has a really old story, you know, stretching back over a thousand years. It's one of the oldest currencies still in use across the globe, which is quite a feat. This long history gives the Pound a certain weight, a sense of tradition and stability for many people living in the UK. It’s not just a means of exchange; it's a part of the country's identity, a symbol of its independent spirit. This deep-rooted connection means any talk of changing the currency would always be a very big deal, often stirring up strong feelings among the population.

For centuries, the Pound has seen the UK through many different times, from periods of great expansion to moments of challenge. It has remained the consistent form of payment, adapting its look and feel, but always keeping its core value. This long track record, in some respects, made it harder for people to imagine giving it up for a newer, collective currency. The idea of adopting the Euro meant letting go of something very familiar and deeply ingrained in daily life, something that had been passed down through many generations.

Its standing as a global reserve currency, even if it's not as dominant as it once was, also plays a part. The Pound is widely traded and accepted in many places around the world. This international presence means that changing it would have had really broad effects, not just within the UK, but also for businesses and individuals who deal with British money every single day. So, the decision about the Euro was never just about economics; it was also about history, identity, and the UK's place on the world stage, basically.

- Lion Monkey Meme

- Is Travis Scott Neurodivergent

- Kristi Lee Salary

- Chloé Chevalier Twitter

- How Much Is Shawn Killinger Worth

Britain's Path to Europe and the Opt-Out

Britain's relationship with European integration has, frankly, always been a bit different from other countries. While many European nations were keen to form closer unions after the Second World War, the UK often approached these ideas with a certain amount of caution. It eventually joined the European Economic Community (EEC), the forerunner to the European Union, in 1973. However, even then, there were debates about how much control Britain should give up, you know, to a larger European body.

When discussions began in earnest about creating a single European currency, the Euro, the UK found itself at a crossroads. Other countries were pushing for deeper economic integration, seeing a shared currency as a way to boost trade, cut costs, and foster greater unity. Britain, however, was hesitant. Its leaders and many of its citizens felt that giving up the Pound would mean giving up too much control over their own economy. This feeling was, in a way, a consistent theme throughout Britain's time in the European project.

This hesitation led to what is known as an "opt-out" clause. During the negotiations for the Maastricht Treaty in the early 1990s, which set the groundwork for the Euro, the UK secured a special agreement. This agreement meant that Britain would not be obliged to join the single currency, even if it met the economic conditions. This was a pretty big deal, actually, setting the UK apart from many of its European partners and showing its distinct approach to the idea of a united Europe.

The Maastricht Treaty and the Euro Criteria

The Maastricht Treaty, signed in 1992, was a really significant moment for European integration. It established the framework for the European Union as we know it today, and a very key part of it was the plan for Economic and Monetary Union (EMU), which included the creation of the Euro. To join the Euro, countries had to meet a set of strict economic criteria, often called the "Maastricht criteria." These rules were put in place to ensure that countries entering the Eurozone had stable economies, which was seen as pretty vital for the success of the new currency.

These criteria included things like having low inflation, stable long-term interest rates, and manageable government debt and deficits. The idea was to prevent countries with very different economic situations from joining, which could, you know, potentially create problems for the shared currency. While the UK, at various times, might have met some of these criteria, the decision not to join was never purely about meeting the numbers. It was more about a fundamental choice regarding economic sovereignty and national control, basically.

The opt-out secured by the UK meant that even if it fulfilled all the economic conditions, it still had the right to decide whether or not to adopt the Euro. This was a unique position, setting Britain apart from many other EU member states who were committed to joining once they met the criteria. It highlighted Britain's distinct approach to its role in Europe, a tendency to pick and choose aspects of integration that it felt best suited its own interests, which is a bit different from other countries, you know.

Economic Arguments For and Against Joining the Euro

The debate over whether the UK should adopt the Euro was, honestly, a very lively one, with strong arguments on both sides. Economists, politicians, and ordinary people weighed the potential gains against the possible losses. It wasn't just about what was good for big business; it was also about what might happen to people's jobs, their savings, and the overall cost of living. This discussion really showed how complex such a big decision can be, in some respects.

The Case for Joining

Supporters of the UK joining the Euro often pointed to several potential benefits. For one thing, they argued that it would make trade with other European countries much simpler and cheaper. Businesses wouldn't have to worry about changing currencies, which would cut down on transaction costs and the risks associated with exchange rate fluctuations. This, they believed, would lead to more trade, more investment, and ultimately, more jobs and economic growth in the UK. It seemed like a pretty straightforward way to boost the economy, you know.

Another argument was about price transparency. With a single currency, it would be much easier for consumers to compare prices for goods and services across different European countries. This increased transparency could, in theory, lead to more competition and lower prices for everyone. Furthermore, some felt that being part of the Eurozone would give the UK a stronger voice in global financial matters, as it would be part of a larger, more powerful economic bloc. It was seen as a way to increase influence and stability, basically.

There was also the idea that joining the Euro would bring greater economic stability. Being part of a large currency area could protect the UK from sudden shocks in global markets, as the Eurozone's sheer size would provide a buffer. It was thought that this stability would encourage more long-term investment, as businesses would face less uncertainty. So, for many, the Euro represented a path to greater prosperity and a more secure economic future, arguably.

The Case Against Joining

However, those who opposed joining the Euro had equally strong, if not stronger, arguments. The main concern was the loss of monetary policy control. If the UK adopted the Euro, the Bank of England would no longer be able to set its own interest rates. Instead, these would be decided by the European Central Bank (ECB) for the entire Eurozone. Critics argued that this would mean losing a really important tool for managing the UK economy, especially during times of boom or bust.

For example, if the UK economy was slowing down, the Bank of England could cut interest rates to encourage borrowing and spending. But if it was part of the Eurozone, the ECB might be raising rates to control inflation in other parts of Europe, which could harm the UK's economy. This loss of flexibility was seen as a very big risk. It was felt that the UK's economy was simply too different from those of other European countries to thrive under a one-size-fits-all monetary policy, you know.

Another major point of contention was the potential impact on the housing market. Interest rates have a very direct effect on mortgage payments, and many worried that if the UK couldn't control its own rates, it could lead to housing bubbles or crashes. There were also concerns about the cost of converting all the money, adapting systems, and the general disruption that such a huge change would bring. For many, keeping the Pound was about preserving economic independence and the ability to steer Britain's own financial ship, basically.

The Role of Public Opinion and Political Will

Beyond the economic theories, the decision about the Euro was deeply influenced by what ordinary people thought and what politicians wanted. Public opinion in the UK was, honestly, pretty consistently against adopting the Euro. People often felt a strong connection to the Pound Sterling, seeing it as a symbol of national identity and sovereignty. The idea of giving up their own money for a shared European currency felt like a loss of control, a bit like giving up a piece of what made Britain unique, you know.

Throughout the years, various polls showed that a significant majority of the British public preferred to keep the Pound. This strong public sentiment made it very difficult for any political party to seriously push for Euro adoption. Even leaders who might have personally seen economic benefits were aware that such a move would be deeply unpopular with voters. So, the political will to join was simply not there, despite some economic arguments in its favor, apparently.

Different political parties also had different views, but even within parties, there were divisions. Some politicians saw the Euro as a logical next step in European integration, while others viewed it as a step too far, threatening national independence. This internal debate, combined with the clear public reluctance, meant that despite being a member of the European Union for many years, the UK never seriously moved towards adopting the Euro. The political calculations, in some respects, always leaned towards maintaining the status quo with the Pound.

What Currency Does England Use Today?

So, to answer the main question directly: no, England never used the Euro as its national currency. Today, and throughout its history, the official currency of England, and indeed the entire United Kingdom (which includes Scotland, Wales, and Northern Ireland), remains the Pound Sterling. You will find banknotes and coins denominated in Pounds and pence when you visit. This has been the case since the Euro was introduced in 1999 for non-cash transactions and in 2002 for physical currency, and it continues to be the case today, as a matter of fact.

Even after the UK voted to leave the European Union in 2016, a process often called Brexit, the currency situation did not change. The decision to leave the EU was a separate matter from the currency choice, though both were rooted in similar feelings about sovereignty and control. The Pound Sterling continues to be a freely floating currency, its value determined by global markets. This means its exchange rate against other major currencies, like the Euro or the US Dollar, can change daily, which is just how many currencies work.

For travelers coming to England, this means you will need to exchange your currency for Pounds Sterling. While some larger shops or tourist spots might accept Euros, especially in London, it's not the norm, and you'll likely get a poor exchange rate. It's always best to use the local currency. So, if you're planning a trip, make sure you have your Pounds ready, or a way to get them from ATMs, which are very common, you know. The Pound is here to stay, it seems.

Frequently Asked Questions About England and the Euro

What currency does England use?

England uses the Pound Sterling, which is often shown with the symbol £. This is the official money for the whole United Kingdom, including Scotland, Wales, and Northern Ireland. It has been the currency for a very long time, and it's what you'll use for all your purchases and payments across the country, basically.

Is the UK part of the Eurozone?

No, the UK is not part of the Eurozone. The Eurozone is the group of European Union countries that have adopted the Euro as their official currency. The UK always maintained its own currency, the Pound Sterling, and never joined the Eurozone, even when it was a member of the European Union. This was due to a special agreement it had, you know, allowing it to opt out.

Why did the UK keep the Pound?

The UK kept the Pound for several reasons, mostly related to a desire to maintain control over its own economic policy. Many felt that giving up the Pound for the Euro would mean losing the ability to set interest rates and manage the economy independently. There was also a strong sense of national identity tied to the Pound, and public opinion was consistently against joining the Euro. So, it was a mix of economic and political reasons, arguably.

Where Britain Stands on Currency Today

Looking at things today, the decision for England, and the wider UK, to keep the Pound Sterling seems pretty firm. The debates that once raged about joining the Euro have largely faded, especially after the country's departure from the European Union. The Pound continues to be a key part of the UK's economic framework, giving the Bank of England the ability to set its own interest rates and respond to the unique needs of the British economy. This independence, in some respects, is highly valued by many within the country.

The UK's economic path, with its own currency, allows for a specific kind of flexibility. This means that when global economic shifts happen, or when the country faces its own financial challenges, its policymakers can react directly, without needing to coordinate with a larger group of nations. This ability to tailor economic responses is seen by many as a significant benefit of not being in the Eurozone, you know. It provides a distinct way of managing the country's money matters.

For anyone interested in global finance or planning a visit to Britain, it’s clear that the Pound Sterling remains the currency of choice. It’s a reflection of a long history and a deliberate decision about national economic direction. To learn more about how the UK's central bank manages this important currency, you can always check out information from the Bank of England. Also, learn more about economic history on our site, and perhaps explore this page about UK

- 3 Is

- Where Is Anderson Cooper Today

- Is Euro Used In Uk

- Ed Sheerans Family Life

- Roger Federer Children Not His

Prevention Of Dissociative Identity Disorder

Arnold Schwarzenegger: Is He Still Alive? Debunking Death Hoaxes

DID vs DO vs DONE 🤔 | What's the difference? | Learn with examples