Did UK Ever Use Euro? The Full Story Of Britain's Currency Choice

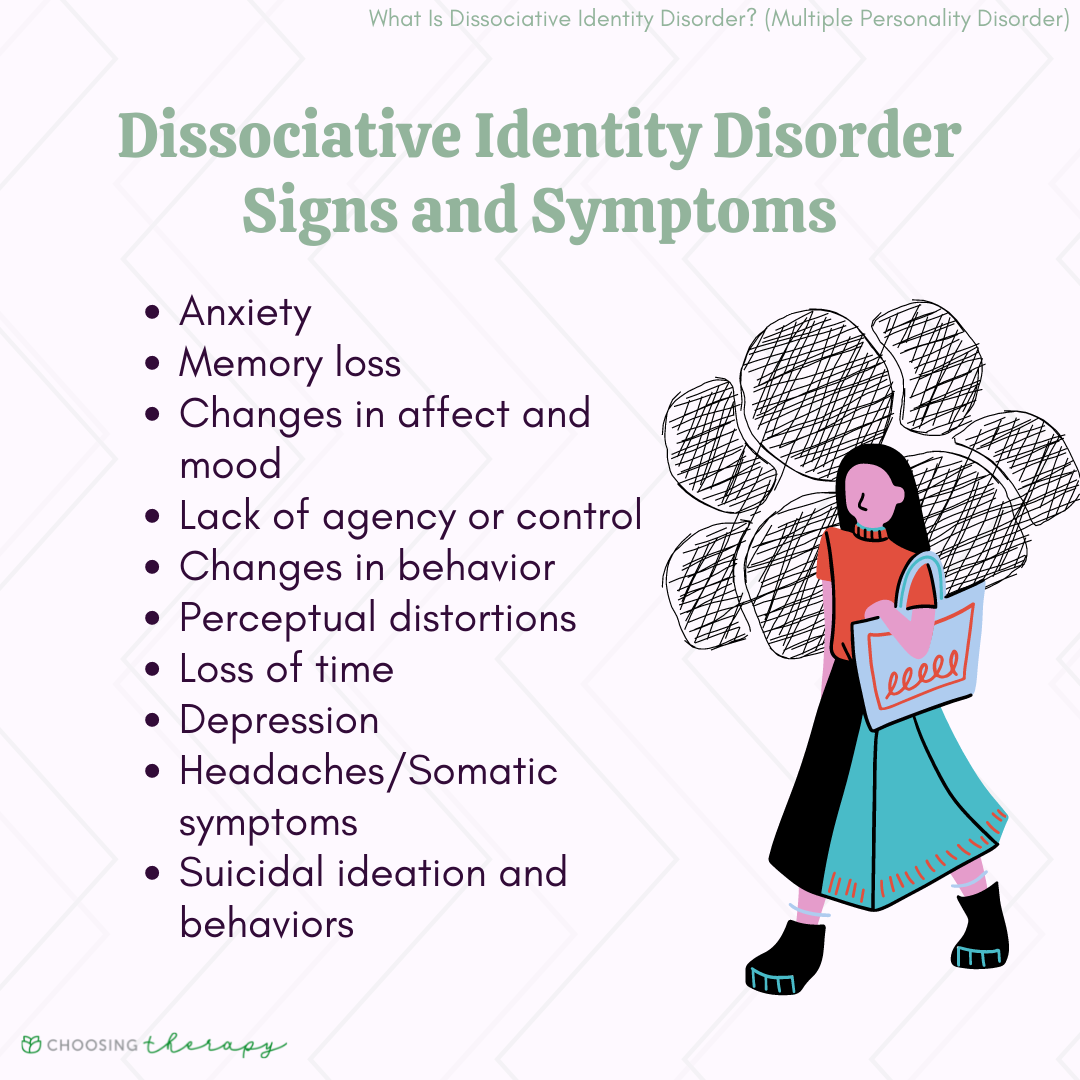

The question, 'did UK ever use Euro,' comes up quite a bit, especially when people talk about money across Europe. It's a straightforward query, yet it opens up a rather interesting discussion about a nation's financial path and its connection to a wider economic family. You know, sometimes a simple word like 'did' can even be part of an initialism, like 'DID' for Dissociative Identity Disorder, which involves distinct identities, as some texts explain. But here, we're talking about something else entirely, about currency and a country's big choices.

You see, the Euro, that common currency for many European countries, came into being at a specific time, creating a huge economic area. This monetary union aimed to make trade smoother and connections stronger among its members. So, it's pretty natural for someone to ask if a big player like the United Kingdom ever got involved with that shared money system.

This article will explore the United Kingdom's currency story, explaining why the British Pound has stayed the national money, even with the Euro right next door. We will look at the big decisions, the economic thinking, and the public feelings that shaped this choice, giving you a full picture of the UK's monetary independence, so to speak.

- Who Played Officer Tenpenny

- Batman With Tommy Lee Jones

- Overtime Megan Nudes

- Dont Challenge The Lady Billionaire Full Movie

- Curry Cannons Latest

Table of Contents

- The Simple Answer: No, the UK Never Used the Euro

- Why the UK Opted Out: Key Reasons

- The Euro's Birth and Britain's Stance

- What If? Imagining a Euro-Using UK

- Post-Brexit: The Pound's Continued Reign

- Frequently Asked Questions

The Simple Answer: No, the UK Never Used the Euro

To answer the main question directly: no, the United Kingdom never used the Euro as its official currency. The British Pound Sterling, often just called the Pound, has been the money of the UK for centuries, and it remains so today. This is a fact that sometimes surprises visitors or those who think all European Union members automatically adopted the Euro, but that's just not how it worked, as a matter of fact.

The UK was a member of the European Union for many years, joining back in 1973. However, membership in the EU did not mean a country had to give up its own money and take on the Euro. There were specific rules and conditions for adopting the Euro, and some countries, like the UK, had special agreements that allowed them to keep their existing currency. This arrangement was a big part of the UK's relationship with the wider European project, you see.

A Look at the Pound Sterling

The Pound Sterling has a very long and rich history, making it one of the oldest currencies still in use. It has been around in various forms for over a thousand years, dating back to Anglo-Saxon times. This long history gives the Pound a certain weight and recognition on the global stage, something that was quite important to many people in Britain, anyway.

- Alyx Star Biography

- How Much Did Tammy Weigh At Her Heaviest

- James Rodriguez Current Girlfriend

- Princess Diana

- Escape To The Dream Jonathan Parents

For generations, people in the UK have used pounds, shillings, and pence, even though the system changed to decimal currency in 1971. The image of the monarch on banknotes and coins is a familiar sight, and it helps to shape a sense of national identity tied to the currency. So, giving up such a deeply rooted symbol for a new, shared currency was always going to be a big discussion, naturally.

Why the UK Opted Out: Key Reasons

The decision not to join the Euro was not a sudden one; it was a choice made after a lot of thought and discussion over many years. There were several important reasons why successive British governments, and indeed a good portion of the public, decided to stick with the Pound. These reasons often came down to a mix of economic principles, political control, and feelings about what it means to be British, basically.

One of the biggest concerns was about losing control over the UK's own economy. When a country joins the Euro, it gives up its ability to set its own interest rates or manage its currency's value. These are powerful tools that governments and central banks use to keep the economy stable, so giving them up was a pretty big deal, you know.

Economic Sovereignty and Control

A key reason for keeping the Pound was the desire to maintain economic sovereignty. This means having the freedom to make independent decisions about things like interest rates and the money supply. The Bank of England, the UK's central bank, has the job of setting interest rates to control inflation and support economic growth. If the UK had adopted the Euro, these decisions would have been made by the European Central Bank (ECB) in Frankfurt, Germany. This would have meant less direct control over the UK's own financial well-being, which was a worry for many, quite frankly.

Having an independent currency also allows a country to adjust its exchange rate. If the economy is struggling, a weaker currency can make exports cheaper and more attractive to other countries, helping to boost trade. Conversely, a stronger currency can make imports cheaper. Losing this flexibility was seen as a significant disadvantage, particularly for an economy like the UK's, which relies heavily on trade and financial services. It's almost like losing a key tool from your toolbox, if you think about it.

The Five Economic Tests

In 1997, the Labour government, led by Prime Minister Tony Blair, set out five economic tests that would need to be met before the UK would consider joining the Euro. These tests were designed to make sure that joining the Euro would be good for the British economy and not cause problems. They were pretty detailed and covered a lot of ground, so to speak.

The five tests were:

- Are business cycles and economic structures compatible so that we and others could live comfortably with euro interest rates on a permanent basis?

- If problems emerge, is there sufficient flexibility to deal with them?

- Would joining the Euro create better conditions for businesses to invest in Britain?

- What impact would joining the Euro have on the UK's financial services industry?

- Would joining the Euro promote growth, stability, and a lasting increase in jobs?

These tests were never fully met, according to the government's assessments. Each time the tests were reviewed, the conclusion was that the UK's economy was not sufficiently aligned with the Eurozone to make a smooth transition. This meant that the economic conditions just weren't right for such a big change, apparently.

Public Opinion and National Identity

Public opinion played a very big part in the UK's decision to stay out of the Euro. Many people in Britain felt a strong connection to the Pound as a symbol of their national identity and independence. There was a widespread feeling that giving up the Pound would mean giving up a piece of what made Britain unique. This sentiment was quite powerful, you know.

Polls consistently showed that a majority of the British public did not want to adopt the Euro. This strong public feeling meant that any government considering joining the Euro would face a lot of opposition. Political leaders had to listen to what the people wanted, and in this case, the people wanted to keep their own money. It was, in a way, a very clear message.

The Euro's Birth and Britain's Stance

The Euro officially came into existence on January 1, 1999, initially as an accounting currency for financial transactions. Euro banknotes and coins then entered circulation on January 1, 2002. This was a huge moment for Europe, bringing together the economies of many nations under one shared currency. It was a bold step, truly, aimed at making Europe more connected and competitive on the global stage.

Even as the Euro was being planned and launched, the UK had already made its position clear. It was supportive of the idea of a single currency for those countries that wanted it, but it also wanted to keep its own options open. This approach was a hallmark of the UK's relationship with the European project for many years, in some respects.

Early European Monetary Integration

The idea of a single European currency had been around for a long time, even before the Euro itself. Efforts towards greater monetary cooperation in Europe began decades earlier, with various attempts to stabilize exchange rates among European currencies. The European Monetary System (EMS) was one such effort, aiming to create a zone of monetary stability. The UK was part of some of these early steps, but often with reservations, or at least a cautious approach.

Britain's experience with the Exchange Rate Mechanism (ERM), a part of the EMS, in the early 1990s was particularly influential. The UK joined the ERM in 1990 but was forced to leave on 'Black Wednesday' in September 1992, after facing immense pressure on the Pound. This experience left a lasting impression on policymakers and the public, making many wary of giving up control over their currency again. It was a rather difficult time, actually.

The Maastricht Treaty and Opt-Out Clause

The formal path to the Euro was laid out in the Maastricht Treaty, signed in 1992. This treaty established the European Union and set out the criteria for countries to join the single currency. Crucially for the UK, it included a special 'opt-out' clause. This clause meant that the UK was not obliged to adopt the Euro, even if it met the economic criteria. This was a unique agreement, giving the UK a distinct position within the EU regarding its currency, so.

This opt-out was a significant diplomatic achievement for the UK at the time. It allowed Britain to remain a full member of the European Union, enjoying the benefits of the single market, without having to commit to the single currency. It reflected a long-standing British preference for a looser, more flexible relationship with European integration, rather than a deeper political union. This kind of arrangement was, you know, a very important part of the deal.

What If? Imagining a Euro-Using UK

It's interesting to think about what might have happened if the UK had decided to join the Euro. This is a topic that economists and political thinkers have discussed quite a bit over the years. The impacts would have been far-reaching, affecting everything from daily life to the country's place in the world. It’s a hypothetical situation, of course, but it helps us understand the significance of the choice that was made, more or less.

Joining the Euro would have meant significant changes for businesses and ordinary people. Prices would have been displayed in Euros, and all transactions would have used the new currency. It would have simplified travel and trade with Eurozone countries, but it would have also meant giving up a lot of economic control, as we've talked about. It's a complex picture, really.

Potential Economic Impacts

If the UK had joined the Euro, the biggest economic change would have been the loss of an independent monetary policy. The Bank of England would no longer set interest rates. Instead, the European Central Bank would have done so, based on the needs of the entire Eurozone. This might have meant interest rates that were not ideal for the UK's specific economic situation at certain times. For example, if the UK economy was slowing down but the rest of the Eurozone was booming, the ECB might raise rates, which would hurt the UK, in a way.

On the other hand, joining the Euro could have brought some benefits. Businesses might have faced lower transaction costs when trading with Eurozone partners, as there would be no currency exchange fees or risks. It could have also made the UK more attractive for foreign investment from countries that prefer to operate within a single currency area. However, the potential downsides, like losing the ability to devalue the currency during a downturn, were seen as too risky by many, quite frankly.

Political and Social Considerations

Beyond the economic arguments, there were significant political and social considerations. Adopting the Euro would have been a very visible symbol of deeper integration with Europe. For those who valued national sovereignty and a distinct British identity, this was a major concern. The Pound, with its long history and royal imagery, is a powerful symbol, and giving it up would have been a big step towards a more unified European identity. This was, you know, a very emotional topic for many people.

The debate around the Euro also touched on broader questions about the UK's relationship with the European Union itself. Was the UK simply a trading partner, or was it part of a larger political project? The decision to keep the Pound was, in many ways, a reflection of the UK's preference for a less integrated

- Skz Roblox Accounts

- Bathhouse Flatiron

- Blondie Happy Gilmore

- Who Played Alice In Twilight

- Neu Family Care Southgate

Prevention Of Dissociative Identity Disorder

Arnold Schwarzenegger: Is He Still Alive? Debunking Death Hoaxes

DID vs DO vs DONE 🤔 | What's the difference? | Learn with examples