Discovering A Top Tulsa Tax Preparer: What To Look For

Finding a truly great tax preparer can make a big difference for your peace of mind and your wallet, especially here in Tulsa. You might feel a little overwhelmed by tax season each year, wondering if you're doing everything just right or if you're missing out on some savings. A good tax helper really can change that feeling, making the whole process much smoother for you.

Many people, honestly, find tax rules a bit confusing, and that's perfectly normal. There are so many forms, and the rules seem to shift around quite a bit. It’s almost like trying to put together a puzzle with pieces that keep changing shape. This is where someone who really knows their stuff can step in and help you out.

This guide is here to help you figure out what makes a tax preparer stand out, giving you some clear ideas on how to pick someone in Tulsa who is, well, pretty good at what they do. We’ll talk about what to look for and what questions to ask, so you feel confident about your choice for this tax year, and even for years to come. You know, like your finances deserve a clear path.

- Abigail Disney Net Worth

- The Mighty Ducks Jussie Smollett

- Kooku Actress

- Mary Patton From Storage Wars

- Brielle Biermann

Table of Contents

- What Makes a Top Tax Preparer?

- Why Get Help with Your Taxes?

- How to Find a Great Tax Preparer in Tulsa

- Common Questions About Tax Preparers

- Working with Your Chosen Preparer

What Makes a Top Tax Preparer?

When we talk about a "top" Tulsa tax preparer, we're really talking about someone who stands at the highest point of their profession. As a matter of fact, the idea of "top" means being of the highest degree, quality, or rank. It suggests a position of preeminence, someone who truly excels in their field. So, what does that look like when it comes to helping with taxes? It's not just about filling out forms; it's much more than that.

A top tax preparer, you know, has a very deep understanding of tax rules. They keep up with all the changes, which happen pretty often, actually. This means they know about new deductions, credits, and anything else that might affect your money. They can spot things you might miss, helping you keep more of your hard-earned cash or avoid problems later on. This level of knowledge is pretty important.

Beyond just knowing the rules, a really good tax helper is also very careful and pays attention to details. They look at your situation specifically, not just as another number. They ask questions to get a full picture of your finances, like your income, any property you own, or even your family situation. This personal touch, you see, helps them give you the best advice for your unique needs. They are, in a way, like a financial detective, finding every piece of the puzzle.

- Do Yankees Jerseys Have Names

- Estee Lauder Bonus Days

- Winifred Walzer

- Roger Federer Children Biological

- How Old Was Arnold In Jingle All The Way

Furthermore, a top preparer is someone you can trust. They handle your private financial information with great care, keeping everything safe. They also explain things in a way that makes sense, so you don't feel lost in a bunch of tax talk. They're open about their process and their fees, so there are no surprises. It’s all about building a good relationship based on clear communication, which is really quite valuable.

Why Get Help with Your Taxes?

You might wonder why you should get someone else to do your taxes, especially if you've always done them yourself. Well, for one thing, tax rules can be really confusing. They change often, and keeping up with all those changes can feel like a full-time job on its own. A professional, naturally, spends all their time keeping up with these things, so you don't have to.

Another reason is that a good preparer can often find ways to save you money that you might not know about. They know about all the deductions and credits that fit your situation, which could mean a bigger refund or less money owed. For example, if you own a small business or have certain investments, there are often specific rules that apply, and a pro can help you use those to your advantage. It’s pretty amazing what they can find.

Also, having a professional handle your taxes can save you a lot of time and stress. Instead of spending hours poring over forms and trying to understand jargon, you can hand it over to someone who does this every day. This frees up your time for other things you'd rather be doing, and honestly, it can take a big weight off your shoulders. It’s just a simpler way to get things done, you know?

And then there's the peace of mind. Knowing that your taxes have been done correctly, by someone who really knows what they're doing, is a huge benefit. It means you're less likely to make a mistake that could lead to problems with the tax authorities later on. This kind of assurance, you might agree, is worth a lot. You can sleep better, more or less, knowing things are handled.

How to Find a Great Tax Preparer in Tulsa

Finding someone who is a truly top Tulsa tax preparer takes a little bit of looking around, but it's worth the effort. You want someone who fits your specific needs, whether you have a simple tax situation or something a bit more involved. Here are some steps you can take to find that person, you know, the one who is just right for you.

Check Their Credentials

First off, it's a good idea to see what kind of qualifications they have. Many good tax preparers are Certified Public Accountants (CPAs) or Enrolled Agents (EAs). CPAs are licensed by the state and have a broad knowledge of accounting and tax law. EAs are licensed by the IRS and specialize in tax matters. Both are good choices, but knowing their background can give you some confidence. You can, for instance, often look up their licenses online to make sure they are current. This is a pretty straightforward first step.

You might also find tax preparers who aren't CPAs or EAs but still have a lot of experience. They should, however, have a Preparer Tax Identification Number (PTIN) from the IRS, which is required for anyone who prepares taxes for a fee. This is a basic requirement, so always ask about it. It just shows they are registered with the tax people, which is important, obviously.

Look at Their Experience and Specialties

Consider how long they've been doing this kind of work. Someone with many years of experience has probably seen a lot of different tax situations, which can be very helpful. Also, think about your own situation. Do you own a business? Do you have investments? Do you have unique income sources? Some preparers focus on certain areas, like small business taxes or international tax issues. Finding someone who specializes in what you need can make a big difference, you know? It's like finding a doctor who knows a lot about your specific health concern.

For instance, if you run a local coffee shop here in Tulsa, you'd want someone who understands the specific deductions and reporting rules for small businesses. Or, if you have rental properties, you'd want someone familiar with real estate tax laws. Asking about their experience with situations similar to yours is a good idea. They might have a client or two just like you, which is a pretty good sign.

Read What Others Say

A good way to get a feel for a preparer is to see what other people think of them. Look for reviews online on various platforms. Do people talk about their helpfulness, their clear explanations, or their ability to find savings? While one or two bad reviews shouldn't scare you off entirely, a pattern of negative comments might be a red flag. On the other hand, many positive reviews usually mean they're doing something right. It's almost like asking your friends for recommendations, but on a bigger scale.

You could also ask friends, family, or business contacts in Tulsa if they have someone they recommend. Personal referrals are often very trustworthy because they come from people you know. They can tell you about their actual experience, which is really valuable. Sometimes, the best recommendations come from word of mouth, you know, just casual conversations.

Ask About Fees

Before you commit, always get a clear idea of how they charge for their services. Some preparers charge a flat fee for certain types of returns, while others charge by the hour. Make sure you understand what is included in their fee and if there are any extra costs. You don't want any surprises when it's time to pay the bill. A good preparer will be upfront and clear about their pricing, which is a sign of honesty. It’s pretty simple, really, just ask for the cost.

Compare fees from a few different preparers, but remember that the cheapest option isn't always the best. A slightly higher fee might mean more experience, better service, or a preparer who can find more savings for you. It's about getting good value for your money, not just the lowest price. Think about what you're getting for that cost, and stuff.

Consider Their Availability and Communication

Think about how easy it is to get in touch with them and how they communicate. Do they respond to emails or phone calls in a timely way? Do they explain things clearly, without using too much confusing tax talk? You want someone who is available to answer your questions, especially during tax season, and who makes you feel comfortable asking them. Good communication is, you know, a very big deal when it comes to something as important as your money.

Some preparers offer online portals for sharing documents, which can be really convenient. Others prefer in-person meetings. Consider what works best for you and make sure their methods match your preferences. This helps make the whole process smoother and less stressful for you. It's about finding a good fit for how you like to work, basically.

Common Questions About Tax Preparers

People often have similar questions when they're looking for someone to help with their taxes. Here are a few common ones, with some simple answers to help you out.

What should I look for in a tax preparer?

You should look for someone with proper credentials, like a CPA or Enrolled Agent. Also, check for good experience, especially with situations like yours. Read reviews from other people to see if they are happy with the service. Make sure they communicate clearly and are upfront about their fees. You want someone you feel comfortable talking to, you know, someone who listens.

How much does a tax preparer cost in Tulsa?

The cost can change quite a bit depending on how simple or how complicated your tax situation is. For a very basic return, it might be one price, but if you have a business, investments, or other complex things, it will likely cost more. It's best to ask for a clear quote upfront based on your specific needs. They should be able to give you a pretty good idea of the cost after a brief chat.

Do I really need a tax preparer?

It depends on your situation. If your taxes are very simple, like just one job and no special deductions, you might be able to do them yourself. But if you own a home, have a business, investments, or other things that make your taxes a bit more involved, a preparer can save you time, find more savings, and help you avoid mistakes. Many people find the peace of mind alone is worth it, as a matter of fact. It’s just easier for some folks.

Working with Your Chosen Preparer

Once you've picked a top Tulsa tax preparer, there are a few things you can do to make the process go smoothly. Gather all your documents ahead of time. This includes things like your W-2s, 1099s, receipts for deductions, and any other income or expense records. The more organized you are, the easier it will be for your preparer to do their job quickly and accurately. It helps them help you, you know?

Be honest and open with your preparer about all your financial details. Don't leave anything out, even if you think it's not important. They need the full picture to give you the best advice and make sure your return is correct. They are there to help you, and having all the information helps them do that very well. It's like building a complete story, essentially.

Ask questions if you don't understand something. A good preparer will be happy to explain things in a way that makes sense to you. It's your money and your taxes, so you should feel clear about everything that's happening. You can learn more about tax planning strategies on our site, which might help you think of questions to ask your preparer. Also, you might want to look at this page for common tax forms that you will need to gather.

Make sure you understand what happens next after your return is prepared. Will they file it for you? When should you expect your refund or when do you need to pay? Knowing the timeline and the next steps helps keep everything on track. This helps you stay organized and feel in control of the whole process. It's pretty straightforward, really, just ask for the plan.

Remember that a top tax preparer is someone who offers great service and expertise, helping you feel confident about your financial obligations. They are, you know, a partner in your financial well-being, helping you navigate the tax year with greater ease and clarity. You want someone who puts your interests first and helps you make the most of your situation, which is, honestly, what "top" is all about. For more information on tax rules, you could visit the official IRS website, which has a lot of helpful resources.

- Anna Maria Horsford Net Worth

- Howoldis Donald Trump

- Does Telegram Work In Uae

- Does Shania Twain Have Children

- Johnny Sins Who Is Johnny Sins

Shop Stylish Tops For Women Online | French Theory

Danika Top - Long Sleeve Knit Wrap Top in Beige | Showpo

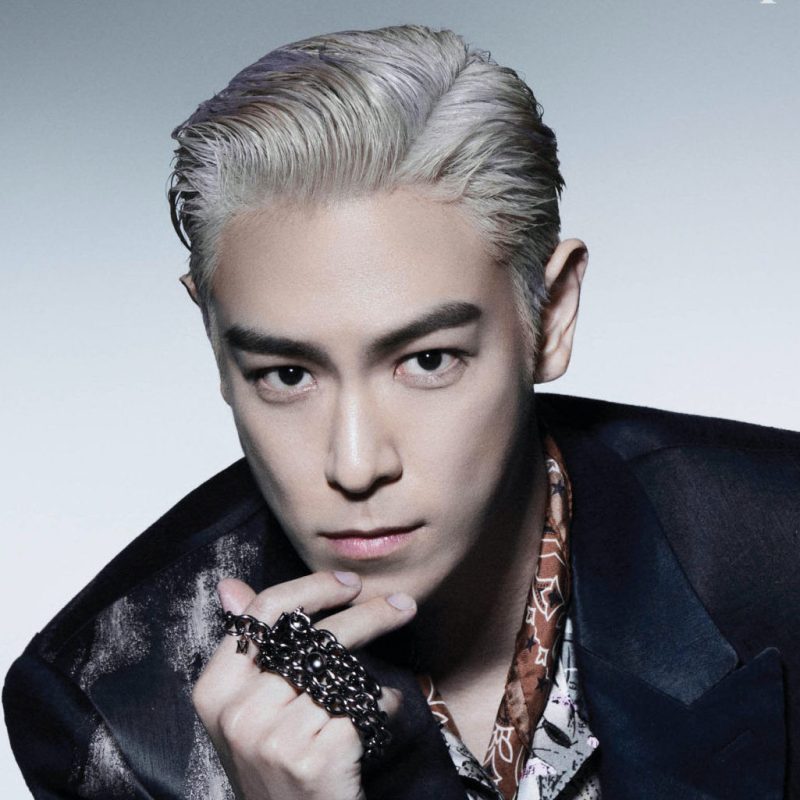

T.O.P (ex BIGBANG) Profile (Updated!) - Kpop Profiles