Unpacking "TISA": Discovering The Real Names Behind The Acronym

Have you ever come across the acronym "TISA" and found yourself a bit puzzled? It's almost like a secret code, isn't it? You might see it pop up in conversations about banking, or perhaps even in news from faraway places, and then suddenly, it appears in a totally different context, like firearms. This can certainly leave anyone scratching their head, wondering, "What exactly is TISA, and what's its real name?" Well, you're not alone in that curiosity, and it's a very good question to ask, actually.

The truth is, "TISA" isn't just one single thing with a single, hidden identity. It's more like a collection of distinct entities, each with its own important purpose and a proper, full name. The confusion often comes from the fact that different organizations and regulations happen to share these four letters, which can make it a little tricky to figure out which "TISA" someone is talking about at any given moment. It's a common source of mix-ups, you know, especially when you're trying to make sense of financial information or even just everyday news.

Today, we're going to pull back the curtain and reveal the various "real names" behind the "TISA" acronym. We'll explore these different identities, from crucial banking regulations that protect consumers to significant financial institutions and even a company that makes something entirely different. So, let's clear up any lingering questions and get a better grip on what "TISA" truly represents in its various forms. It's a bit like solving a little mystery, really.

- Odee Perry Mugshot

- Candy Pangilinan Husband

- Ryan Gosling Political Beliefs

- Lion Yelling At Chill Monkey

- Forumophillia

Table of Contents

- The Truth About TISA: It's Not Just One Thing

- TISA's Legal Identity: The Truth in Savings Act (Regulation DD)

- What is the Truth in Savings Act?

- Why TISA Matters for Consumers

- TISA in Daily Banking Operations

- TISA's Financial Heart: The Teachers Savings and Loan Society Limited

- A Major Player in Papua New Guinea

- What They Offer

- TISA's Other Identity: Tisas USA Firearms

- Beyond Finance: A Different Kind of TISA

- Why the Confusion Around "TISA" Matters

- Frequently Asked Questions About TISA

The Truth About TISA: It's Not Just One Thing

When someone mentions "TISA," it's completely natural to wonder what they mean. As we've seen, this short combination of letters can point to several very different things, and that's precisely where the occasional mix-up happens. It's a bit like hearing the word "bank" and having to figure out if someone means a river bank or a financial institution, isn't it? Context is everything, and with "TISA," there are a few distinct contexts we need to look at, so it's really important to get it right.

The term "TISA" doesn't refer to a single person or a celebrity, so we won't be sharing a biography or personal details in that way. Instead, it represents a set of regulations, a specific financial group, and even a manufacturing business. Each of these entities plays a distinct role in its own area, and knowing their full names helps clear up any confusion. It's all about understanding the specific "real name" that applies to the conversation at hand, which, you know, makes things much clearer for everyone involved.

TISA's Legal Identity: The Truth in Savings Act (Regulation DD)

One of the most prominent uses of "TISA," especially if you're involved in the financial world or simply have a bank account, points to a very important piece of legislation. This is the Truth in Savings Act, which is often called Regulation DD. It's a federal rule here in the United States, and it plays a pretty big part in how banks interact with their customers, especially when it comes to deposit accounts. This act, you see, has a clear mission, and it's all about making things fair and open for you, the consumer.

- Raena Triple Charm Age

- Bubble Bratz

- Catherine Deneuve And Kate Walsh

- Limbus Company R34 Animation

- Connor Mcdavid Career Stats

What is the Truth in Savings Act?

The Truth in Savings Act, or TISA, was put into place to help people make really good, informed choices about their bank accounts. This regulation, which became effective back in June 1993, basically tells banks what they need to do when they offer deposit accounts. It covers everything from checking accounts and savings accounts to certificates of deposit, or CDs. The National Credit Union Administration also issues regulations to implement this act for credit unions, so it's quite broad in its reach, actually.

The core idea behind TISA is transparency. It requires banks to give consumers clear disclosures about their accounts. This means you should get information that helps you compare different options easily, so you can pick the best account for your needs. It's about providing the fundamental knowledge necessary for consumers to understand what they're getting into, which, you know, is pretty vital for anyone managing their money.

Why TISA Matters for Consumers

For you, the consumer, TISA is a pretty big deal because it ensures you get the full picture before you open an account. Think about it: without these rules, banks might not have to tell you about certain fees, or how interest is calculated, or even the exact annual percentage yield. TISA makes sure that doesn't happen. It's designed to enable you to make really informed decisions about bank accounts, so you're not caught off guard by unexpected charges or confusing terms. This helps you compare offers effectively, which is just good practice for your finances, isn't it?

The American Bankers Association, for instance, often engages with regulators regarding these rules, showing how important they are to the banking industry as a whole. The goal is always to balance consumer protection with practical operations for financial institutions. So, you can see, this act is a cornerstone of consumer protection in banking, making sure you have the data you need to manage your money smartly, and that's a pretty valuable thing, I think.

TISA in Daily Banking Operations

From the perspective of someone working in a bank, TISA, or Regulation DD, is something we deal with every single day. For example, I work in a branch of a foreign bank operating in the United States. We open deposit accounts, but only for individuals who are already customers of our foreign bank. Even in this specific situation, the principles of TISA apply, ensuring that those customers receive the proper disclosures about their accounts. This course, you know, really introduces Regulation DD and the Truth in Savings Act, which govern a financial institution's presentation of deposit accounts to consumers, so it's a big part of our training.

It provides an overview of the disclosure requirements for deposit accounts, including checking and savings accounts and CDs. Even things like discretionary overdraft services, which might seem unregulated, actually fall under Regulation DD, implementing the Truth in Savings Act. So, it's pretty clear that TISA's influence is widespread, touching many aspects of how banks operate and present their services. It's a continuous effort to ensure compliance, which, in turn, protects consumers, and that's a key part of our work.

TISA's Financial Heart: The Teachers Savings and Loan Society Limited

Moving away from banking regulations, "TISA" also refers to a significant financial institution in a completely different part of the world. This is The Teachers Savings and Loan Society Limited, often simply called "TISA." This organization has a very specific and important role in its home country, and it's quite a success story in its own right, actually. It's a great example of how the same acronym can represent something entirely distinct, yet still related to finance, just in a different context.

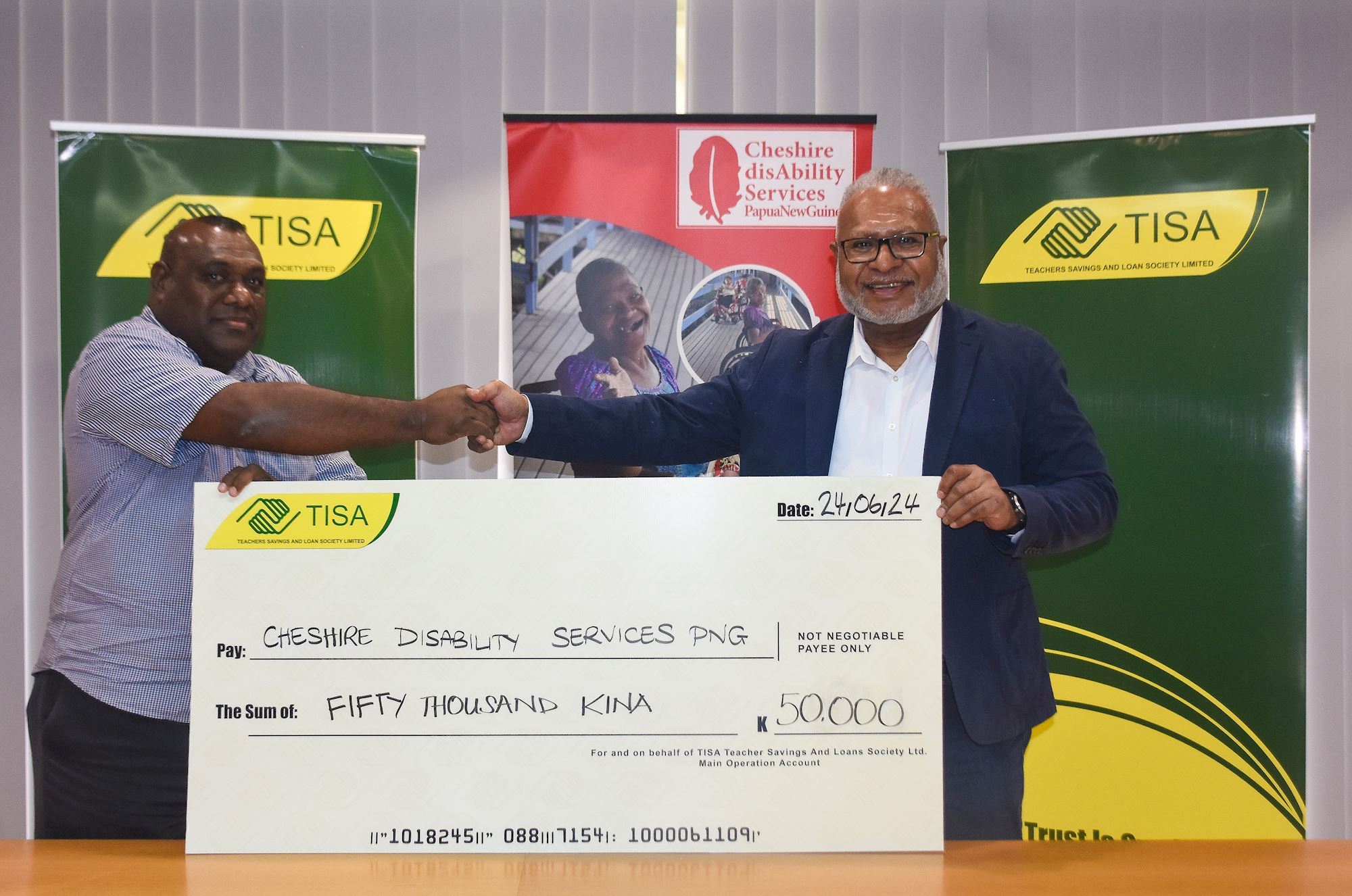

A Major Player in Papua New Guinea

The Teachers Savings and Loan Society Limited, or TISA, is quite a big deal in Papua New Guinea. In fact, it's recognized as the largest savings and loans society in that country. This means it plays a vital role in helping many people manage their money, save for the future, and access financial services. Its size and influence suggest it's a foundational part of the financial landscape for many individuals there, providing essential support, which is pretty impressive, you know.

Being the largest in its category means it serves a substantial portion of the population, likely offering accessible and reliable ways for people to save and borrow. This kind of institution is crucial for economic stability and growth, especially in developing regions. It helps individuals build financial security, and that's a truly valuable contribution to any community, wouldn't you say?

What They Offer

As a savings and loan society, TISA in Papua New Guinea offers a range of savings accounts designed to help its members grow their money. For instance, they might advertise the ability to earn up to 6% interest per annum, which is a pretty attractive rate for savers. This focus on savings and providing good returns helps members achieve their financial goals, whether it's for education, housing, or just building a nest egg. They make it possible for people to save effectively, which, you know, is a core function of such a society.

There are often specific rules about how these savings or funds can be managed, like questions about converting or redeeming TISA funds within certain timeframes, or if there are fees involved. For example, some policies might state that if funds are transferred out or redeemed before a certain period, like 24 continuous months, there could be a temporary suspension of eligibility for new regular savings contracts. These details are important for members to understand, and they highlight the structured way these societies operate to benefit their members, which is pretty standard for financial products.

TISA's Other Identity: Tisas USA Firearms

Now, for something completely different! While the previous uses of "TISA" have been firmly in the financial sector, there's another well-known entity that uses a very similar name, and it has absolutely nothing to do with banking or savings accounts. This just goes to show how an acronym can be adopted by various industries, leading to that initial confusion we talked about. It's a good reminder that context really does matter, doesn't it?

Beyond Finance: A Different Kind of TISA

The "TISA" you might encounter in a completely different context is actually "Tisas USA." This company operates in the firearms industry, offering official parts and accessories for various models. They are known for upgrades for 1911 series pistols, as well as PX-9 and 5.7 models, and even the Fatih .380. So, if you're looking for gun parts or accessories, you'd be looking for Tisas USA, not a banking regulation or a savings society in Papua New Guinea. It's a totally different kind of business, obviously.

This distinct identity highlights the challenge of acronyms. While "TISA" for the Truth in Savings Act and The Teachers Savings and Loan Society Limited are both financial, Tisas USA stands out as an entirely separate entity. It just goes to show that when you hear "TISA," it's always worth pausing for a moment to consider the situation and figure out which "TISA" is being referred to. It's a pretty clear example of how words can take on multiple meanings depending on who's saying them, isn't it?

Why the Confusion Around "TISA" Matters

The fact that "TISA" can mean so many different things isn't just a minor curiosity; it actually has practical implications. For consumers, knowing which "TISA" is being discussed is vital, especially when it comes to financial decisions. If you're looking up information about your bank account, you need to be sure you're reading about the Truth in Savings Act, not about a savings society on the other side of the world, or even a firearm company. This is why clarity is so important, you know, to make sure you get the right information.

For professionals in banking and finance, a deep understanding of Regulation DD (TISA) is a fundamental part of their training, as offered by institutions like the foundational compliance school. They need to be absolutely clear on the disclosure requirements and how they apply to various deposit accounts. This isn't just about following rules; it's about building trust with consumers and ensuring fair practices. It's a continuous learning process, which, you know, keeps everyone sharp and informed.

In a broader sense, this situation with the "TISA" acronym reminds us all to be a little more precise in our communication and to always seek context. Whether you're a consumer trying to understand your bank statement or a professional trying to implement regulations, knowing the "real name" behind an acronym like "TISA" is key to avoiding misunderstandings and making sure everyone is on the same page. It's a small detail, but it makes a pretty big difference, I think.

Frequently Asked Questions About TISA

People often have questions about "TISA" because of its multiple meanings. Here are some common inquiries that come up, helping to clarify what this acronym might mean in different situations.

What is the main purpose of the Truth in Savings Act (TISA)?

The Truth in Savings Act, also known as Regulation DD, is primarily designed to help consumers make informed decisions about their bank accounts. It requires banks to provide clear and accurate disclosures about interest rates, fees, and other terms related to deposit accounts like checking, savings, and CDs. So, it's really all about transparency and giving you the details you need to choose wisely, which, you know, is pretty helpful.

Is TISA a bank?

No, "TISA" itself is not a bank in the general sense. While one prominent "TISA" is The Teachers Savings and Loan Society Limited, which is a financial institution in Papua New Guinea, the acronym "TISA" also refers to a US banking regulation called the Truth in Savings Act. Then there's Tisas USA, which is a firearms company. So, it really depends on which "TISA" you're talking about, as they are very different entities, actually.

How does TISA (Truth in Savings Act) affect my bank account?

The Truth in Savings Act directly affects your bank account by ensuring you receive clear and consistent information about it. This means your bank must provide disclosures about the annual percentage yield (APY), any fees, and how interest is calculated. It helps you understand the true cost and earnings potential of your account, which, you know, makes it easier to manage your money effectively. You can learn more about the Truth in Savings Act on the Federal Reserve's site for more official details.

We invite you to learn more about financial literacy on our site, and to explore how regulations impact you, you might also be interested in this page understanding bank disclosures.

- What Is The Circumference Of The Earth

- Celine Dion Has Died

- Rachel Zegler Siblings

- How Many Miles Circumference Of Earth

- Cast Of Captain America Brave New World

TISA News

TISA News

TISA News