Exploring Richard Fuld Net Worth: A Look At Financial Fortunes

Many people, it seems, often wonder about the financial standing of prominent figures, especially those who played a big part in significant historical events. So, when we talk about someone like Richard Fuld, the former head of Lehman Brothers, the question of his net worth comes up quite a bit. It's a natural curiosity, you know, to think about how much wealth someone accumulates during a long career, particularly in the fast-paced world of finance.

This particular discussion about Richard Fuld's net worth is, in a way, about more than just a number. It's about looking at the journey of a financial professional, the ups and downs of a career, and how public events can really shape a person's financial story. We're going to explore what goes into figuring out a person's wealth, especially for someone in the public eye, and the different factors that can make those numbers change over time. It's not always as simple as it looks, you see.

Now, it's worth noting that the name "Richard" itself has a long and interesting history, with roots in various European languages and meanings like "brave ruler" or "powerful leader." That's a fascinating bit of trivia, really, about the name itself. However, when we talk about Richard Fuld and his net worth, we're focusing on the individual and his unique path in the financial world, not the general meaning of his first name, which is, you know, a different kind of exploration entirely.

- Dry En Aire Acondicionado

- High Taper Fade Black Male

- What Did Billie Eilishs Dad Do

- Who Is Edward Skeletrix

- Taylor Kinney Movies And Tv Shows

Table of Contents

- Understanding Net Worth for Public Figures

- Richard Fuld: A Brief Overview

- The Rise of a Financial Leader

- Executive Compensation and Wealth Accumulation

- The Impact of the 2008 Financial Crisis

- Post-Lehman Brothers and Ongoing Financial Activities

- Challenges in Estimating Net Worth

- Public Perception and Wealth

- Frequently Asked Questions About Richard Fuld

- Conclusion

Understanding Net Worth for Public Figures

When you try to figure out someone's net worth, especially for a person who's been in the public eye, it's a bit like putting together a puzzle. It's not just about how much money they have in the bank, you know. Net worth really means the total value of all their assets minus all their debts. So, that includes things like real estate, investments, company shares, and even valuable personal items, less any loans or other financial obligations. It's a pretty broad picture, honestly.

For someone like Richard Fuld, whose career was so tied to a major financial institution, his net worth would have been very much linked to his compensation from Lehman Brothers. This often involved a base salary, yes, but also a lot of bonuses, stock options, and other benefits that could really add up. These things are often tied to how well the company performs, which, as a matter of fact, can make the numbers fluctuate quite a bit.

It's also important to remember that these figures are often estimates. Unless someone publicly declares all their assets and liabilities, which is pretty rare for most people, any reported net worth is, you know, a calculation based on available public information. This might come from financial disclosures, property records, or, arguably, educated guesses about their investments. It's not always an exact science, that's for sure.

- Gary Oldman Dracula

- Maleny Beltran Desnuda

- John Bolz What Happened

- Young Joey Fatone

- Finishing Transition Words

Richard Fuld: A Brief Overview

Richard Fuld is, of course, best known for his long tenure as the Chief Executive Officer of Lehman Brothers. He spent many years there, climbing the ranks and eventually leading one of the biggest investment banks in the world. His time at the top spanned a period of significant growth for the firm, seeing it expand its operations globally and take on a much larger presence in the financial markets. It was, in a way, a remarkable journey for him and the company.

His career, quite frankly, shows how someone can dedicate a huge part of their working life to one organization. He was known for his intense dedication and, some might say, a very strong personality, which, you know, often comes with leading such a large and powerful institution. This dedication, as a matter of fact, played a big role in how the company operated for many years.

The story of Richard Fuld, however, is very much intertwined with the story of Lehman Brothers' collapse in 2008. This event was a pivotal moment in global financial history, and it, naturally, brought a lot of attention to him and his financial standing. It's a period that many people still talk about today, and it certainly shaped how the public viewed his wealth, too it's almost.

Personal Details and Bio Data

Understanding a person's background can sometimes give you a better sense of their professional path and, by extension, their financial journey. For Richard Fuld, some key details are publicly available, providing a framework for his long career in finance. This information, you know, helps paint a picture of the individual behind the headlines.

| Detail | Information |

|---|---|

| Full Name | Richard Severin Fuld Jr. |

| Born | April 26, 1946 |

| Place of Birth | New York City, New York, USA |

| Nationality | American |

| Education | University of Colorado Boulder (B.A.), New York University (M.B.A.) |

| Known For | Former Chairman and CEO of Lehman Brothers |

| Career Span at Lehman | 1969 – 2008 |

| Primary Industry | Investment Banking, Finance |

These details, you know, give us a basic outline of his life and professional background. They show a person who spent a significant portion of his adult life dedicated to the financial sector. His educational background, as a matter of fact, prepared him for the complex world of high finance, setting the stage for his eventual leadership role at Lehman Brothers.

It's interesting to consider how these foundational elements, like his education and early career choices, played into his overall financial trajectory. For many in the financial world, early decisions can, you know, really set the course for future wealth accumulation. This is, basically, a common thread among people who reach the top levels of major financial firms.

The Rise of a Financial Leader

Richard Fuld's journey at Lehman Brothers began way back in 1969, and he really worked his way up the ladder. He started out in commercial paper, which, you know, is a specific area of finance, and over the years, he took on more and more responsibility. His career path was, in a way, a classic example of someone growing with a company and eventually leading it.

He became the CEO in 1994, and during his time at the helm, Lehman Brothers saw some pretty impressive growth. The firm expanded into new markets, took on bigger projects, and, honestly, became a much more significant player in the global financial landscape. This period of expansion was, you know, very much a reflection of his leadership and the strategies he put in place.

This growth, naturally, also meant increased revenues and, in turn, higher compensation for top executives like Fuld. Investment banking, as a matter of fact, is known for its generous pay structures, especially when the markets are doing well. So, his personal wealth would have been, arguably, growing significantly during these boom years, fueled by the firm's success.

Executive Compensation and Wealth Accumulation

For someone in Richard Fuld's position, at the head of a major investment bank, compensation packages were, you know, pretty complex and quite substantial. It wasn't just a simple salary. Top executives in finance often receive a base salary, yes, but a huge portion of their pay comes from bonuses, which are often tied to performance. These bonuses could be, like, millions of dollars, depending on how well the firm did that year.

Beyond cash bonuses, a significant part of their wealth comes from stock options and restricted stock units. These give executives the right to buy company shares at a certain price or receive shares outright after a period of time. So, if the company's stock price goes up, their wealth increases, sometimes dramatically. This is, basically, a common way for companies to align the interests of their leaders with the interests of shareholders.

Over decades, as a firm like Lehman Brothers grew and its stock value increased, the value of these compensation components for Fuld would have, honestly, accumulated into a very considerable sum. This is how many financial leaders build up their fortunes, you know, through a combination of high salaries, performance-based bonuses, and equity in the companies they run. It's a system designed to reward success, for sure.

The Impact of the 2008 Financial Crisis

The 2008 financial crisis was, without a doubt, a huge turning point for the global economy, and, frankly, for Richard Fuld and Lehman Brothers. The firm, as many people know, collapsed, which was a massive event that sent shockwaves through the financial world. This wasn't just a business failure; it was, you know, a moment that changed how many people viewed the entire financial system.

For Fuld, this meant that his long career at Lehman ended in a very public and, arguably, devastating way. The firm's bankruptcy had a direct and significant impact on his personal wealth, especially the portion tied up in Lehman stock and options. When a company goes bankrupt, its stock typically becomes worthless, which, you know, can wipe out a huge chunk of an executive's paper wealth.

The crisis also brought intense public scrutiny on Fuld and other financial leaders. There were, you know, many questions about executive compensation and accountability, especially when taxpayers' money was being used to bail out other institutions. This public outcry, as a matter of fact, put a lot of pressure on him and other figures from that time, making their financial situations a topic of widespread debate.

Post-Lehman Brothers and Ongoing Financial Activities

After the collapse of Lehman Brothers, Richard Fuld's professional life, naturally, took a very different turn. He didn't just disappear from the financial scene, but his role changed considerably. He moved into different ventures, often in smaller, more private settings, away from the intense public spotlight he had been under. This was, arguably, a significant shift for someone who had led such a large public company.

One of his subsequent ventures involved setting up a new advisory firm, which, you know, focused on providing strategic advice to companies. This kind of work is, basically, common for seasoned financial professionals who still want to be involved in the industry but perhaps in a less public capacity. It allows them to use their extensive experience without the demands of running a huge public corporation.

Estimating his net worth after such a major event becomes even more challenging. While his Lehman-related wealth might have been severely impacted, he would have had other assets, investments, and, you know, potential income from new ventures. These things are often not publicly disclosed, making it very difficult to get a precise figure. So, any numbers you might see are, honestly, just informed estimates based on what's generally known.

Challenges in Estimating Net Worth

Figuring out the exact net worth of someone like Richard Fuld, or really any high-profile individual, is, you know, surprisingly difficult. It's not like they publish their bank statements for everyone to see. Much of their wealth might be held in private investments, trusts, or real estate that isn't easily traceable by the public. This makes getting a precise figure pretty much impossible for most people.

Also, the value of assets can change quite rapidly. Stock portfolios go up and down, real estate values fluctuate, and private equity investments might not have a clear market value. So, a net worth figure from one day might be, like, very different the next, depending on market conditions. It's a moving target, in a way.

Then there's the issue of liabilities. While assets are sometimes publicly visible, debts are almost never. A person could have significant loans, mortgages, or other financial obligations that would reduce their overall net worth. Without knowing these, any estimate is, arguably, incomplete. So, you know, it's a complicated picture, really, when you try to sum it all up.

Publicly reported figures for net worth are, therefore, usually just estimates based on what financial journalists or researchers can piece together from public records and industry knowledge. They often don't include all private holdings or personal debts. This is, as a matter of fact, a common limitation when trying to assess the wealth of private citizens, even very prominent ones. You just don't have all the pieces, you know.

The financial world is, basically, a very private place when it comes to individual wealth. While some disclosures are required for public company executives, once they leave those roles, much of their financial activity can become, like, completely confidential. This makes tracking their true net worth a continuous challenge for anyone outside their inner circle. It's just how the system works, apparently.

Moreover, the concept of "net worth" itself can be interpreted in slightly different ways. Does it include future earnings potential? How are illiquid assets, like private company stakes, valued? These questions, you know, add layers of complexity to the estimation process. It's not a simple calculation, and different methodologies can lead to different reported figures, quite honestly.

Public Perception and Wealth

The public's view of Richard Fuld's net worth is, you know, very much colored by the events of 2008. For many, his wealth became a symbol of the perceived excesses in the financial industry that contributed to the crisis. This perception, as a matter of fact, is something that often happens when a major economic downturn occurs and people look for figures to, arguably, associate with it.

There was a lot of anger and frustration directed at executives who had received large compensation packages while their firms, or the broader economy, faced collapse. This made discussions about their wealth, including Fuld's, very sensitive and, frankly, often emotional. It wasn't just about the numbers; it was about, you know, fairness and accountability.

Even today, when his name comes up, the discussion often turns to his financial standing and what happened during the crisis. This shows how wealth, especially for public figures, is not just a personal matter; it's also, in a way, tied to broader societal discussions about economics, responsibility, and the distribution of money. It's a powerful connection, really.

Frequently Asked Questions About Richard Fuld

Many people have questions about Richard Fuld, especially concerning his financial situation and what happened after Lehman Brothers. Here are some common inquiries that come up, reflecting the public's continued interest in his story. These questions, you know, show how much impact his career had on people's minds.

What is Richard Fuld's net worth after Lehman Brothers?

Estimating Richard Fuld's exact net worth after the Lehman Brothers collapse is, frankly, very difficult for the public. While he lost a significant portion of his wealth tied to Lehman stock, he would have had other assets and investments accumulated over his long career. Public figures' net worth figures are often estimates based on available information, and his current financial situation is, you know, not fully transparent. It's a private matter, basically, for most people.

How did Richard Fuld make his money?

Richard Fuld made his money primarily through his long career at Lehman Brothers. His compensation included a base salary, yes, but a very large part came from substantial bonuses, stock options, and other equity-based incentives. These were tied to the performance of the firm, especially during its years of growth. So, his wealth was, honestly, built through decades of executive leadership in investment banking, which is, you know, a high-paying field.

Is Richard Fuld still wealthy?

While the collapse of Lehman Brothers certainly impacted Richard Fuld's wealth, it's widely believed he retains significant assets. He had accumulated considerable wealth over decades before the crisis, and even after losing a portion, he would have had other investments and income streams. He has also been involved in new ventures since then. So, it's, arguably, safe to assume he is still financially comfortable, though specific figures are, you know, not publicly confirmed.

Conclusion

Exploring the topic of Richard Fuld's net worth really gives us a chance to think about the nature of wealth in the financial world. It highlights how executive compensation works, how market events can reshape fortunes, and, honestly, the challenges in pinning down exact figures for public figures. His story, in a way, is a powerful reminder of the highs and lows that can happen in a long and distinguished career within finance, particularly when it intersects with major historical moments.

Understanding these financial journeys helps us appreciate the broader economic landscape and the complexities involved in assessing personal fortunes. It's a discussion that, you know, continues to evolve as the world of finance changes. For more insights into the history of financial institutions, you might want to explore historical financial records. You can also learn more about financial concepts on our site, and, for a deeper look into the impact of major economic events, feel free to link to this page .

- Olivia Brown Net Worth

- Jamel Wonder Onlyfans

- Melissa Oneil Body

- What Nationality Is Hades66

- Adin Nsfw Teitter

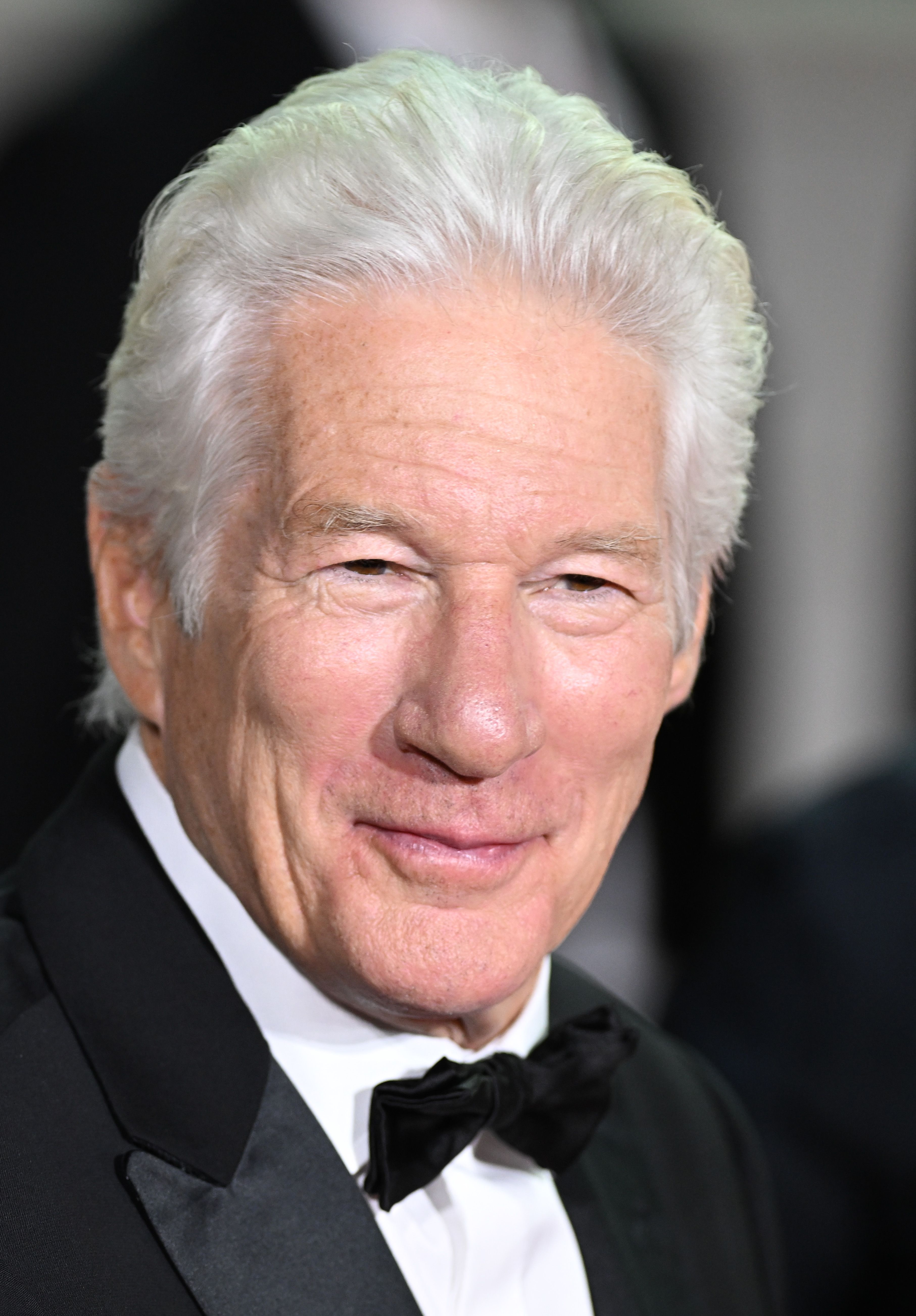

What Happened to Richard Gere? Update on the Actor’s Health and

Longing Review: Richard Gere Leaves Us Longing For A Better Movie In

Richard Gere's Instagram, Twitter & Facebook on IDCrawl