Lendli Loan Reviews: Getting A Clear Picture Of Your Borrowing Choices

Thinking about a personal loan and wondering if Lendli is a good fit for you? Many people, it seems, are looking for ways to handle unexpected costs or consolidate what they owe. Finding a loan that truly helps, without causing more worry, is really important. So, checking out what others say about Lendli loans can, in a way, give you a lot of peace of mind before you make a big decision.

You want to know if a lending option is dependable, right? This article is here to help you get a full view of Lendli loan reviews. We'll look at what folks are saying, what to keep an eye on, and how Lendli stacks up against other choices out there. It's about making sure you feel good about your borrowing path, you know, every step of the way.

Our goal is to give you a straightforward guide to Lendli loans, much like those helpful resources that make using new tech simple and easy to understand. We’ve gathered information to help you figure out if Lendli could be the right solution for your money needs. It’s pretty much like finding a quick way to get answers without any extra fuss, actually.

Table of Contents

- Understanding Lendli Loans: What They Are

- Who is a Lendli Loan For? Your Audience

- What People Are Asking About Lendli Loans

- How Lendli Loans Work: The Application Process

- The Money Side of Things: Rates and Repayment

- What Users Are Saying: Real Lendli Loan Reviews

- Customer Help and Support

- Comparing Lendli to Other Options

- Making Your Decision: Tips for Choosing a Loan

Understanding Lendli Loans: What They Are

Lendli, as a lending service, provides personal loans to people who need money for different reasons. These loans are often unsecured, meaning you don't have to put up property as collateral. This can be a big plus for many folks, as it makes the process a bit simpler, too. People typically use these funds for things like paying off credit card balances, handling emergency bills, or even covering home repair costs. It's a way to get a lump sum of money and then pay it back over a set period, usually with regular monthly payments. So, in a way, it offers a predictable payment schedule.

The core idea behind Lendli, and similar services, is to offer a financial bridge when you need it. They aim to make the process of getting money relatively quick and easy. This is often appealing to people who might not have traditional banking relationships or who need funds pretty fast. You know, sometimes life just throws you a curveball, and you need a quick financial assist.

Who is a Lendli Loan For? Your Audience

People looking into Lendli loans are often those who need a personal loan but might find it hard to get one from a big bank. This could include individuals with a less-than-perfect credit history, or perhaps those who need funds rather quickly. They're usually trying to solve a specific financial problem, like consolidating debt to simplify payments or covering an unexpected bill that just popped up. Their main concern, it seems, is finding a loan they can actually get approved for, with terms that won't make their financial situation worse. They want something straightforward, and that's usually what they're searching for, you know?

- Culpa Mia 3 Movie

- Camilla Araujo Pics

- Hunter Renfrow Clemson

- Kerolaychavespvd

- Lisa Niemis Life After Patrick

Their interests often include managing their money better, finding affordable ways to borrow, and understanding all the costs involved. They really want to avoid surprises. Their pain points are often rejection from traditional lenders, high interest rates, and complicated application processes. So, when they search for "lendli loan reviews," they're usually looking for honest opinions about ease of use, approval chances, and how fair the loan terms are. They're trying to figure out if Lendli can truly help them out, you know, without a lot of hassle. They want to know if it's a good deal, basically.

A current trend in lending, actually, shows more people are looking for online loan options that offer quick decisions. This is because, well, life moves fast, and sometimes you just don't have time to wait weeks for a bank to decide. People are also really keen on transparency, wanting to see all fees and interest rates upfront. This desire for clarity and speed is a big part of why services like Lendli get a lot of attention. It's a sign of the times, you could say.

What People Are Asking About Lendli Loans

When folks look up "lendli loan reviews," they often have some common questions on their minds. It's pretty natural to want to get the full picture before committing to something important like a loan. Here are a few things people frequently wonder about, which is useful to consider.

Is Lendli a legitimate lender?

This is a big one, actually. People want to know if Lendli is a real, trustworthy company or just some fly-by-night operation. They're looking for signs of credibility, like proper licensing and clear contact information. It's a fair question, you know, especially with so many online services out there these days.

What are the typical interest rates and fees with Lendli?

Borrowers are really keen on understanding the actual cost of a loan. They want to know about interest rates, any origination fees, late payment charges, and basically, all the little bits that add up. This helps them compare Lendli's offerings to other places and decide if it's a good financial choice for them. They're trying to figure out if it's affordable, after all.

How long does it take to get money from Lendli?

For many, speed is a very important factor. If they need money for an emergency, they're not going to want to wait weeks. So, knowing how quickly Lendli processes applications and disburses funds is a key piece of information for potential borrowers. They want to know if it's a fast process, basically, which is totally understandable.

How Lendli Loans Work: The Application Process

Getting a loan with Lendli, like with many online lenders, usually involves a pretty straightforward application process. They've tried to make it as simple as possible, which is a big plus for a lot of people. You typically start by visiting their website, which is where you'll find the application form. It's designed to be user-friendly, basically, so you can fill it out without too much trouble.

Getting Started with an Application

When you begin, you'll need to provide some personal details. This includes things like your name, address, and contact information. They'll also ask about your employment status and how much you earn. This information helps them get a sense of your financial situation. It's a pretty standard procedure, you know, for any kind of loan application. You're just giving them the basic facts.

You'll also need to state how much money you want to borrow and what you plan to use it for. This helps Lendli understand your needs and offer a suitable loan product. Sometimes, they might even suggest a different amount or term based on your profile, which is actually quite helpful. It's all part of them trying to match you with the right loan, you see.

What Lendli Looks For

Lendli, like any lender, looks at several things when deciding whether to approve a loan. They'll consider your credit history, of course, but often they're a bit more flexible than traditional banks. They might also look at your income stability and your ability to repay the loan. This means they're trying to get a full picture of your financial health, which is a good thing. They want to make sure you can actually handle the payments, basically.

They might also use other data points beyond just your credit score to assess your risk. This can be good news for people who have had some financial bumps in the past but are now in a better place. It gives them a chance, you know, to get the money they need. It’s a broader look at your financial situation, which is often appreciated.

The Money Side of Things: Rates and Repayment

Understanding the costs involved with any loan is really important, and Lendli loans are no different. You want to know exactly what you're getting into, financially speaking. This includes not just the amount you borrow, but also the interest you'll pay and any extra fees. It's all part of being a smart borrower, basically.

Interest and Fees

Lendli's interest rates can vary quite a bit, depending on your creditworthiness and the loan terms you choose. It's pretty typical for online lenders, actually, to have a range of rates. They also might have an origination fee, which is a small charge taken from the loan amount before you even get the money. It's something to be aware of, you know, so there are no surprises. Always ask about all the fees involved.

It's a good idea to get a clear breakdown of all these costs before you agree to anything. This way, you can calculate the total amount you'll pay back over the life of the loan. Knowing this total figure helps you compare Lendli to other options more accurately. You want to make sure it fits your budget, after all, and isn't going to cause more stress down the road.

Making Payments Easy

Repaying your Lendli loan is usually set up to be pretty straightforward. Most online lenders offer automated payments, where the money is taken directly from your bank account each month. This can be super convenient, actually, because you don't have to remember to send a payment. It helps you stay on track and avoid late fees, which is always a good thing.

They usually provide a clear payment schedule, so you know exactly when each payment is due and how much it will be. This predictability is often a big comfort to borrowers. It helps them plan their budget and manage their money without any guesswork. It's about making the process as smooth as possible, you know, for everyone involved.

What Users Are Saying: Real Lendli Loan Reviews

Looking at what real people say about their experiences with Lendli loans can give you a lot of insight. It's like getting a peek behind the curtain, you know? While every person's situation is unique, common themes often come up in reviews, which can be really helpful when you're trying to make a choice. These reviews, in a way, paint a picture of what you might expect.

The Good Stuff

Many people who've used Lendli often talk about the speed of the application and approval process. They appreciate how quickly they can get a decision and, if approved, how fast the funds land in their bank account. This is a big deal for those who need money urgently, you know, for unexpected situations. It really seems to stand out for a lot of users, actually.

Another positive point frequently mentioned is the ease of the online platform. Users often find it simple to navigate and understand, which makes the whole borrowing experience less stressful. It's pretty much designed to be user-friendly, which is something many people value. The convenience factor is definitely a plus, too.

Things to Think About

On the flip side, some Lendli loan reviews might bring up concerns about interest rates, especially for those with lower credit scores. While Lendli might approve people who traditional banks wouldn't, these approvals sometimes come with higher costs. It's something to really consider, you know, before you sign on the dotted line. You want to make sure the cost is manageable for you.

Some users also mention that the loan amounts offered might not always be as high as they hoped for. This can be a bit of a letdown if you have a larger financial need. It's important to remember that lenders assess risk, and the amount they offer often reflects that assessment. So, it's good to have realistic expectations, basically, when you're looking for a loan.

Customer Help and Support

The quality of customer support can really make a difference, especially when you're dealing with something as important as your money. People often want to know if they can easily reach someone if they have a question or run into a problem with their Lendli loan. Good support can turn a potentially frustrating situation into a smooth one, you know?

Reviews often touch on how responsive Lendli's customer service team is. Some people report positive experiences, finding the staff helpful and quick to resolve issues. They might mention that getting answers was pretty straightforward, which is always a relief. It makes you feel like you're not just a number, basically.

However, like with any service, there might be times when others find it a bit harder to get through or feel their questions weren't fully answered. It's something to keep in mind, as customer service experiences can vary. It's a good idea to check out recent reviews to get the most up-to-date picture of their support quality. You want to feel supported, after all.

Comparing Lendli to Other Options

When you're thinking about a Lendli loan, it's always smart to look at other choices too. No single loan is perfect for everyone, and what works well for one person might not be the best fit for another. So, comparing Lendli to other lenders, like credit unions, traditional banks, or even other online lending platforms, can really help you find the best deal. It’s like shopping around for anything important, you know?

For instance, traditional banks might offer lower interest rates if you have excellent credit, but their application process can be slower. Credit unions often have very competitive rates and a more personal touch, but you usually need to be a member. Other online lenders might specialize in different types of loans or cater to specific credit profiles. Each option has its own pros and cons, basically.

Lendli often stands out for its speed and willingness to work with a broader range of credit scores. However, you might find lower rates elsewhere if your credit is really strong. So, it's about weighing what matters most to you: speed, cost, or flexibility. You want to pick the option that aligns with your specific needs, after all. Learn more about personal loans on our site, and link to this page to explore different loan types.

Making Your Decision: Tips for Choosing a Loan

Choosing a personal loan, whether it's from Lendli or somewhere else, is a pretty big financial step. It’s important to take your time and make a choice that you feel good about. Here are some simple tips to help you along the way, actually, to make sure you pick the right loan for you.

First, figure out exactly how much money you need and what you'll use it for. Don't borrow more than you really need, as this just means you'll pay more in interest. Being clear about your needs helps you focus your search. It's about being practical, basically, with your money.

Next, take a good look at your budget. Can you comfortably make the monthly payments? Use an online loan calculator to see how different interest rates and loan terms affect your payments. You want to make sure the payments fit easily into your current spending plan. This helps you avoid any financial strain down the road, you know.

Always compare offers from several different lenders. Don't just go with the first one you see. Look at the interest rates, any fees, and the repayment terms. Sometimes, a slightly higher interest rate might be worth it if the fees are much lower, or vice versa. It's about finding the best overall deal for your situation, basically. You can find more general information about responsible borrowing at a trusted financial resource like the Consumer Financial Protection Bureau, which is very helpful.

Read the fine print very carefully before you sign anything. Make sure you understand all the terms and conditions, especially about late fees or prepayment penalties. If something isn't clear, ask questions until it makes sense. You really want to know what you're agreeing to, you know, before you commit. It's your money, after all, and you want to be smart about it. Today, on July 26, 2024, it's more important than ever to be financially savvy.

- Cave Johnson Voice Actor

- Off Stamp Error Type V

- Cyrus Zachariah Shepherd Oppenheim

- Raja Jackson Height

- Pnd Cover Album

Lendli

Loan Le

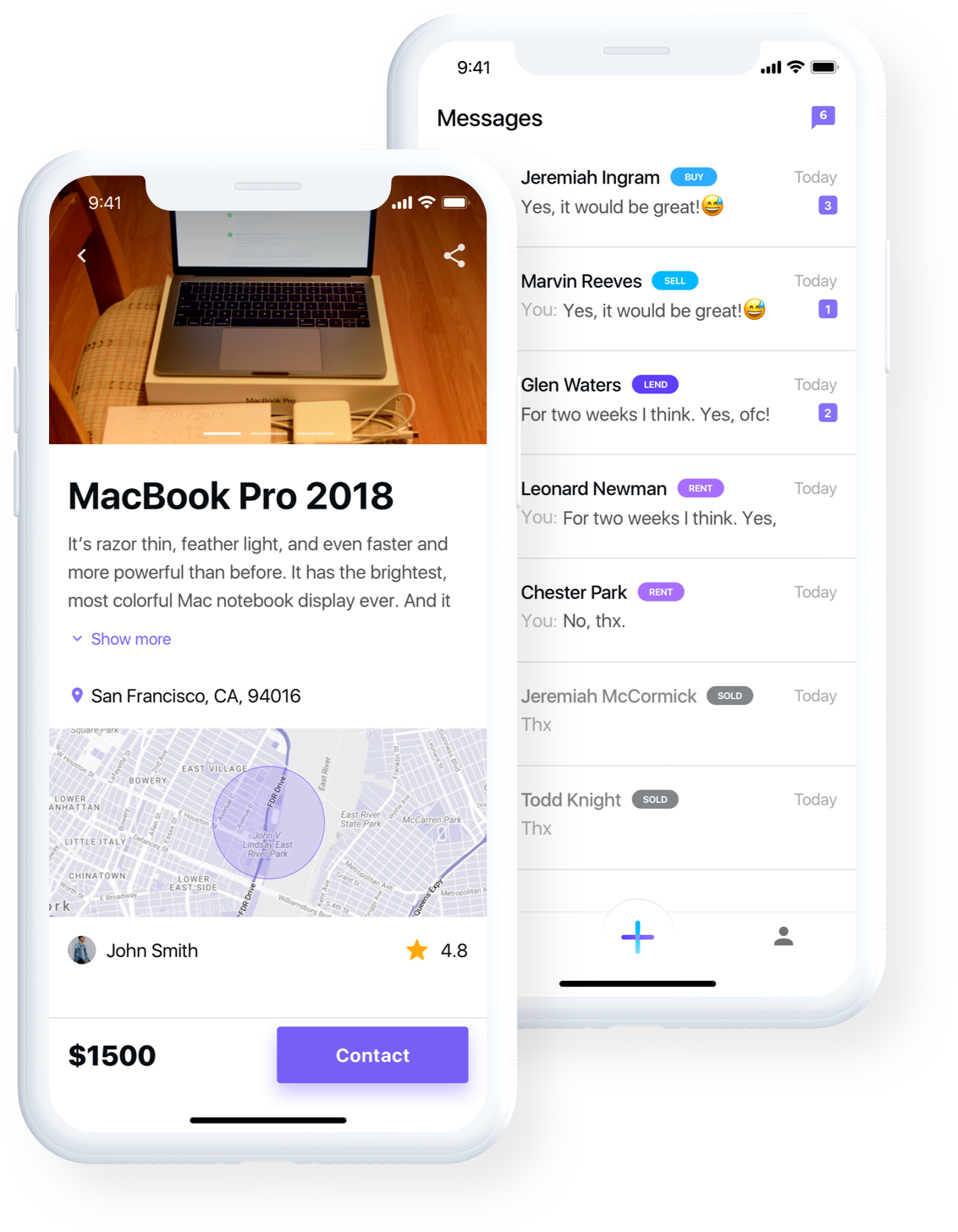

Lendli - Full Project on Behance