Unlock Faster Financial Answers With Lendli Text: What You Need To Know Today

Getting quick answers to your money questions feels really important these days, doesn't it? We live in a world where things move very fast, and waiting around for information can be a real hassle. You might be trying to sort out a loan, or maybe just check on a payment. So, finding a way to get those details without much fuss is something many people look for.

This is where the idea of `lendli text` comes into play, you know. It's about making financial conversations simpler, bringing them right to your phone through text messages. Think about how often you text friends or family; it's a very common way to communicate. Could this same easy method work for your financial needs, too it's almost?

We will look at what `lendli text` could mean for you, how it fits into the changing world of money services, and why it might just be the direct link you've been looking for. This approach, you see, offers a different way to stay connected and get things done.

Table of Contents

- What Exactly is Lendli Text?

- Why Lendli Text is Gaining Traction in Fintech

- Practical Uses for Lendli Text

- The Benefits of Using Lendli Text for You

- Addressing Concerns: Security and Privacy with Lendli Text

- The Future Outlook for Lendli Text and Financial Services

- People Also Ask About Lendli Text

- Final Thoughts on Lendli Text

What Exactly is Lendli Text?

`Lendli text` refers to a way of interacting with financial service providers using simple text messages. It is, in essence, a direct line for getting information or making requests related to your money matters. This could involve anything from asking about a loan application to getting an update on your account.

It aims to cut down on the usual steps you might take, like calling a customer service line or logging into a complex app. The idea is to make getting financial help as straightforward as sending a message to a friend. So, it's pretty much about making things easier for everyone.

This method focuses on quick, direct communication that fits into your daily routine. It's about bringing financial services closer to how you already communicate. Many people, for instance, prefer a quick text over a long phone call.

- What Was John Candys Net Worth

- Rubi Cortez Erome

- Jcpenney East Brunswick Hours

- Ronaldo Birth Date

- Geoffrey Zakarian Net Worth

The Idea Behind Text-Based Financial Help

The core thought behind `lendli text` is to offer instant access to financial information. You might be out and about, or perhaps just at home, and a question pops into your head. Instead of having to stop what you are doing, you could just send a text. This really saves time.

It's about making financial support available right when you need it, in a format that feels natural. This approach recognizes that people are busy and want solutions that fit into their fast-paced lives. A quick text, you know, can often be all you need.

The aim is to remove friction from financial interactions. No more waiting on hold, no more searching through websites. Just a simple message, and you get a response, which is a bit like magic for some people.

How It Differs from Regular App Interactions

You might be used to logging into apps for your financial tasks, or even social media platforms to connect with services. Sometimes, that can be a bit of a challenge, you know. There are often usernames, passwords, and security checks that can make getting in a little tricky.

Think about trying to log into a social media site; sometimes you have trouble logging in, or maybe it's because the owner only shared it with a small group of people, or they changed who can see it. `Lendli text` tries to skip those hurdles. It uses your phone number as the primary connection point.

It's designed for quick, specific queries, not for browsing complex account details. This means you don't have to worry about using a device you've used to log in before for best results, or remembering old passwords. It's a direct channel, which is, honestly, a simpler way to connect.

This directness can be a huge relief for people who just want a quick answer without the fuss. It's a way to get information without needing to be fully "logged in" to a larger system. So, it really streamlines things quite a bit.

Why Lendli Text is Gaining Traction in Fintech

The financial technology sector, or fintech, has seen a real surge lately, you know. Companies like Klarna Group plc are even considering big moves like an initial public offering in New York, which shows how much interest there is in new financial ideas. This fast pace means everyone is looking for fresh ways to serve customers.

`Lendli text` fits right into this trend because it offers a very modern way to communicate. It's about making financial services more accessible and user-friendly, which is something many growing companies want. The market is very open to innovations that make life easier.

This method helps financial providers connect with a wider range of people. Not everyone is comfortable with complex apps or phone calls, so text messaging provides a familiar and simple alternative. It's a bit like meeting people right where they are, in terms of their communication habits.

The Speed Factor in Modern Finance

In today's financial world, speed is often key, you know. People don't want to wait days for a loan update or hours for a customer service response. They want answers now, or at least very quickly. `Lendli text` is built to deliver on that expectation.

A quick text message can get a response much faster than a traditional email or phone call. This means less time spent wondering and more time knowing. It's a rather significant improvement for many daily financial tasks.

This quick exchange helps people make decisions faster and feel more in control of their money. It reduces the stress of waiting, which is, honestly, a big plus for anyone dealing with financial matters.

Meeting Users Where They Are

Most people carry a mobile phone, and texting is a common activity for almost everyone. `Lendli text` takes advantage of this widespread habit. It means financial services can reach you directly on a device you already use constantly.

This approach makes financial help less intimidating and more approachable. You don't need to download a new app or learn a new system; you just use your phone's regular messaging function. It's a very natural way to communicate, so.

By using a familiar communication method, `lendli text` helps bridge the gap between financial institutions and everyday users. It makes finance feel less distant and more personal, which is, you know, a good thing for building trust.

Practical Uses for Lendli Text

There are many ways `lendli text` could be put to good use in your daily financial life. It's about making common tasks much simpler and faster. You might be surprised at how many things you could do with just a few messages.

Here are some examples of how `lendli text` could work:

- Quickly checking the status of a loan application.

- Getting an instant balance update for an account.

- Receiving payment reminders or due date notifications.

- Asking simple questions about service terms or fees.

- Confirming transactions or recent activity.

- Getting help with a small issue, like updating contact details.

Getting Answers About Your Loan

Imagine you've applied for a loan, and you're just waiting to hear back. Instead of calling or checking an online portal, you could simply send a text asking for an update. `Lendli text` could tell you if your application is approved, or if they need more information.

You might also have questions about your loan's interest rate or payment schedule. A quick text could get you those details without any fuss. It's about getting specific answers quickly, which is very helpful when you're planning your finances.

This direct line means you stay informed without much effort. It gives you peace of mind, knowing you can get quick updates on important financial matters. So, it's pretty much a straightforward way to keep tabs on things.

Staying Updated on Your Financial Services

Beyond loans, `lendli text` could keep you informed about all sorts of financial services. You could get alerts for large transactions, or notifications if your account balance drops too low. These quick updates help you stay on top of your money.

It could also be used for confirming changes to your account or letting you know about new services that might interest you. This way, you're always in the loop without having to actively seek out information. It's a bit like having a personal assistant for your finances.

This constant, yet unobtrusive, stream of information can help you feel more secure and connected to your financial providers. It's a rather effective way to manage your financial awareness.

The Benefits of Using Lendli Text for You

For you, the user, `lendli text` brings several clear advantages. It's designed with your convenience and peace of mind in mind. The whole point is to make your financial life just a little bit easier, you know.

These benefits go beyond just getting quick answers; they affect your overall experience with financial services. It's about creating a smoother, less stressful interaction. So, there are quite a few good things to consider.

Saving Precious Time

One of the biggest perks of `lendli text` is the time it saves. Think about all the minutes, or even hours, you've spent waiting on hold for customer service. Or maybe the time it takes to log into an app, find the right section, and then type out your question.

With `lendli text`, you send a message, and you get a response. It's that simple. This means you can get on with your day faster, using that saved time for things you actually want to do. It's a very efficient way to handle quick queries.

This efficiency translates into less frustration and more productivity in your personal life. It's about making financial tasks fit seamlessly into your schedule, rather than disrupting it. That, you know, is a pretty valuable thing.

Feeling More Connected to Your Services

When you can text a financial provider and get a quick, relevant answer, it can make you feel more connected to them. It feels like there's a direct line, a real person (or a very smart system) ready to help. This kind of connection builds trust.

Unlike trying to log into a complicated system where you might face issues like "trouble logging in" or questions about which device you've used before, texting is straightforward. It fosters a sense of accessibility and responsiveness. You feel like your questions matter, and that's important.

This direct and easy access can make you feel more in control of your financial dealings. It removes some of the barriers that can make financial institutions seem distant or hard to reach. So, it really helps to make things feel more personal.

Addressing Concerns: Security and Privacy with Lendli Text

Any time you talk about financial information, security and privacy are, quite rightly, big concerns. People worry about their personal details being safe. With `lendli text`, these worries are certainly valid, and it's important to think about how they would be handled.

A reliable `lendli text` service would need to have strong security measures in place. This isn't just about sending a simple message; it's about protecting sensitive financial data. So, knowing what to look for is rather helpful.

The goal is to provide the convenience of texting without compromising on the safety of your information. This means careful planning and the use of smart technology to keep everything secure.

Keeping Your Information Safe

For `lendli text` to be trustworthy, any service using it would need to use secure methods for sending messages. This means using encryption, which scrambles your messages so only the intended recipient can read them. It's a bit like putting your message in a secret code.

Also, there would need to be strong ways to verify who you are. This could involve asking for specific pieces of information that only you would know, or sending a one-time code to your phone. This helps make sure it's really you texting, and not someone else.

These measures are designed to prevent unauthorized access to your financial details. They are there to give you peace of mind when you use such a service. So, keeping things safe is a very big part of the whole idea.

What to Look for in a Secure Lendli Text Service

If you ever come across a `lendli text` service, you should look for certain signs of security. Check if the service clearly states its privacy policies and how it protects your data. Transparency is, you know, a very good sign.

Look for information about how they verify your identity before sharing any sensitive details. A good service will have clear steps to confirm it's you. Also, be wary of services that ask for too much personal information through text.

It's also a good idea to ensure the service comes from a reputable financial institution. Knowing who you are communicating with helps a lot. Always be careful about sharing personal financial details over any text service unless you are certain of its security.

The Future Outlook for Lendli Text and Financial Services

The idea of `lendli text` is part of a bigger movement in financial services to become more user-friendly and accessible. As technology keeps moving forward, we can expect even more creative ways for people to manage their money. It's a very exciting time for financial innovation.

This kind of direct communication could become a standard way to interact with banks and other financial providers. It simply makes sense for many everyday tasks. So, its presence might just grow over time.

The goal is to make financial services less of a chore and more of a seamless part of your life. This includes making it easier for everyone to get the help they need.

Growing with Technology

As artificial intelligence (AI) gets smarter, `lendli text` services could become even more sophisticated. AI could help answer more complex questions instantly, making the text conversations feel even more natural and helpful. This means quicker, more accurate responses.

We might see `lendli text` integrating with other smart tools, perhaps even helping you budget or offering personalized financial tips based on your questions. The possibilities are, you know, quite vast for how this could evolve.

This ongoing growth in technology means that text-based financial interactions will likely become even more powerful and useful in the years to come. It's a pretty clear path forward.

A More Accessible Financial World

Ultimately, `lendli text` aims to make financial services more accessible to everyone. For people who find

- Kris Jenner Bikini Pics

- Weeknd Wife

- Eiichiro Oda Net Worth 2023

- Dj Mustard Producer

- Ella Langley Nationality

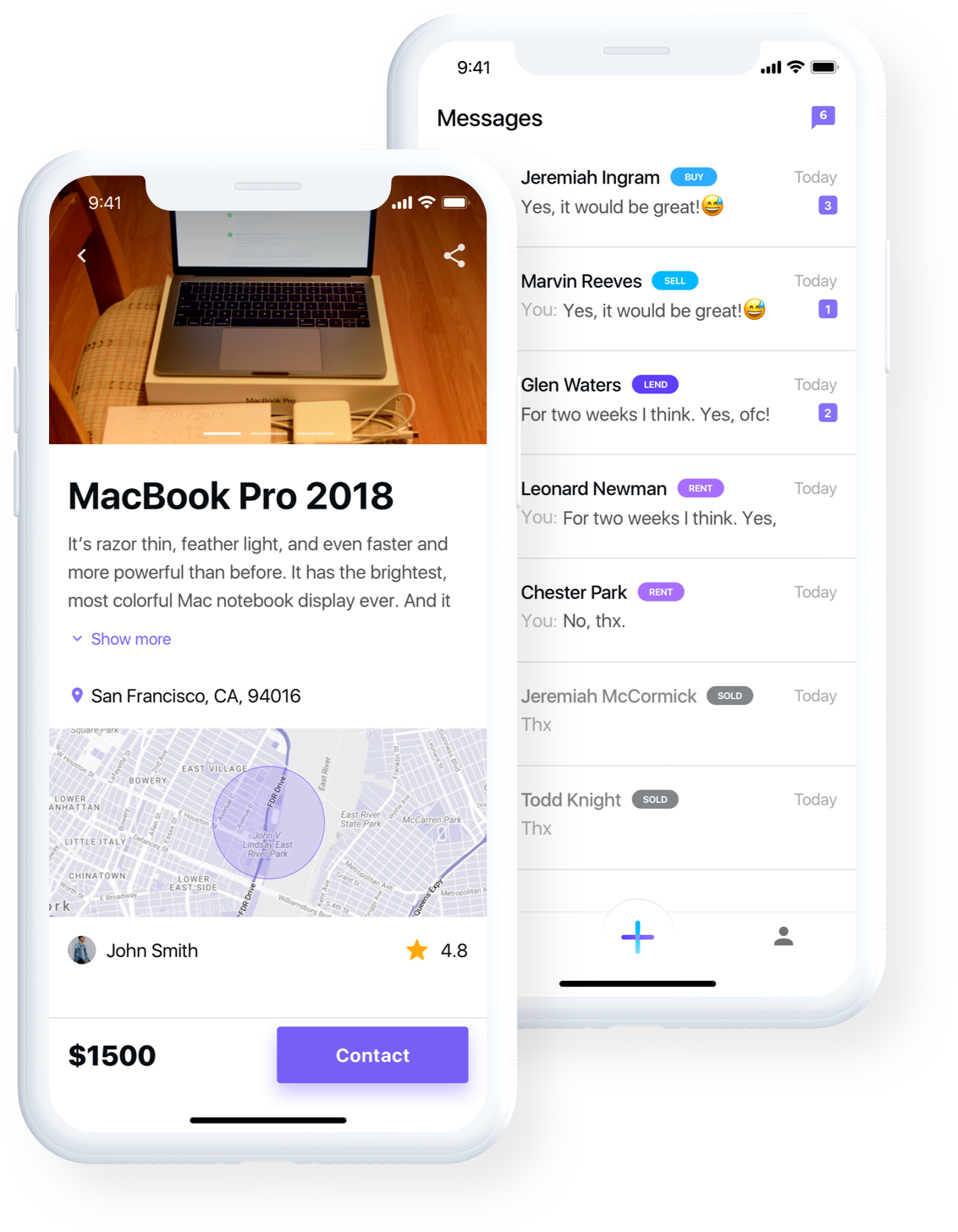

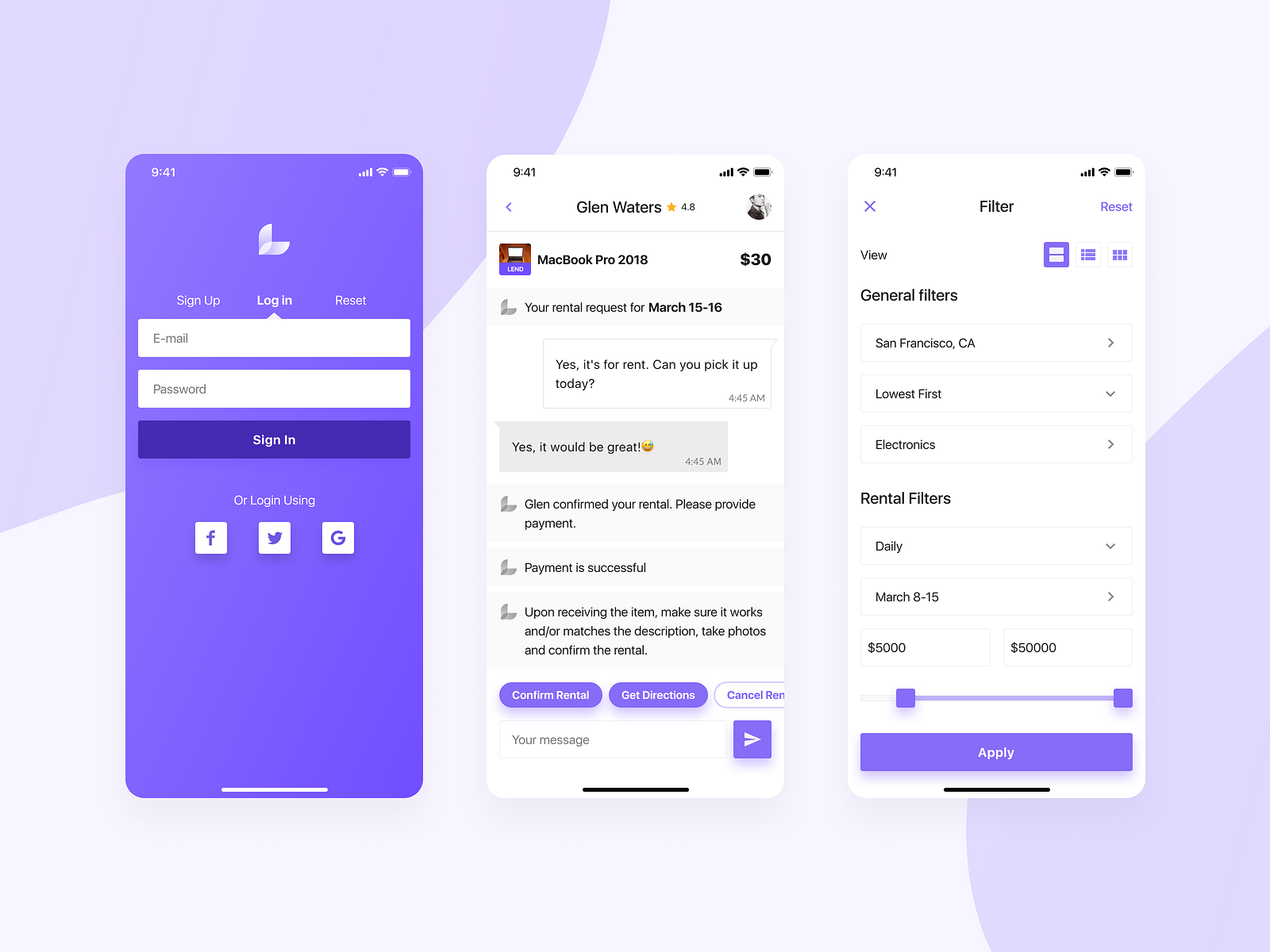

Lendli

Lendli - Full Project on Behance

Lendli App Design by khutornyi roman on Dribbble