Lendli Explained: Your Guide To Smarter Financial Connections

Finding the right way to handle money, whether you are seeking a bit of support or aiming to help others, can sometimes feel a little complicated. Many people look for options that are clear, reliable, and just feel right. So, what if there was a different kind of financial connection, one built on clarity and mutual benefit?

Well, that's where something like lendli comes into the picture, offering a fresh perspective on how individuals and communities can come together financially. It aims to make financial interactions more straightforward, a bit like a well-paved road for your money matters, if you will. This approach could really change how we think about getting or giving financial help, you know?

This article will take a closer look at lendli, explaining what it is, how it works, and why it might be a good fit for your financial journey. We will explore its key features, discuss how it creates a dependable environment, and consider what makes it stand out. By the end, you should have a much clearer idea of how lendli could help you achieve your financial goals, or perhaps even assist others in reaching theirs.

- Puna Reiran Akame Onlyfans

- Liam Nesson Young

- Are Kyra Sedgwick And Julia Roberts Related

- Lilo Age

- Can You Eat Raw Snow Peas

Table of Contents

- What is lendli?

- How lendli Works: A Smooth Process

- The Accuracy of lendli: Building Trust

- Why lendli Matters for You

- Comparing lendli: Understanding the Differences

- Getting Started with lendli

- Frequently Asked Questions About lendli

- The Future of Financial Connections with lendli

What is lendli?

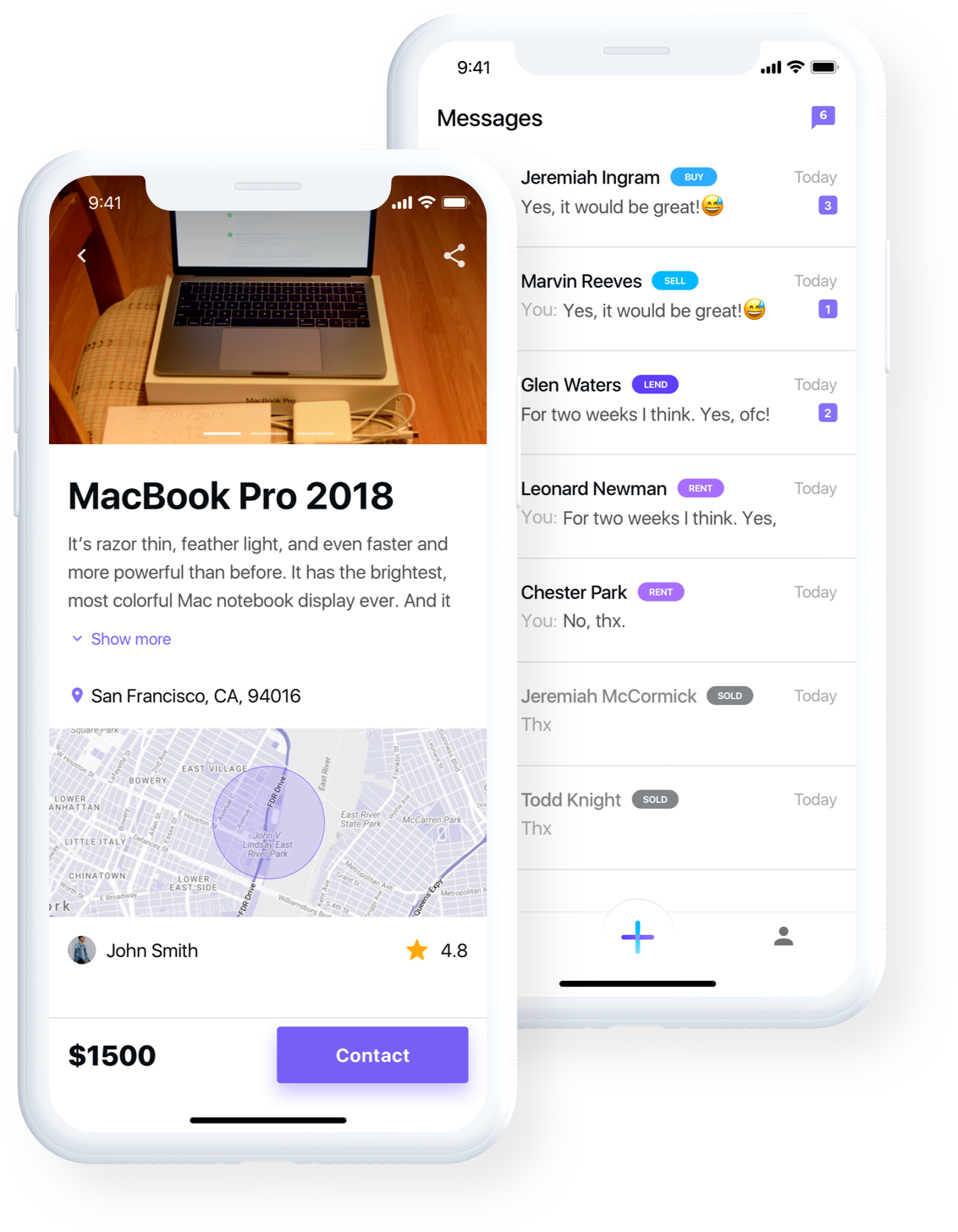

lendli, it's almost a new idea, really, in the world of personal finance. Imagine a place where people can connect directly for financial needs, rather than going through many layers of traditional institutions. It's built on the concept of community and mutual support, trying to foster a more direct way for funds to move between those who have a little extra and those who could use some assistance. This platform, you see, tries to simplify what can often be a rather complex process.

It acts, in a way, as a bridge. Think of it like a social network, but for financial interactions. Just as you might log into Facebook to connect with friends and family, sharing updates and experiences, lendli focuses on connecting people for financial sharing and support. This model tries to cut down on the usual hurdles, making financial transactions feel more personal and less intimidating, which is pretty important for many people.

The core idea behind lendli is to create a more accessible and fair financial ecosystem. It is, in some respects, a response to the need for more flexible and transparent options that cater to everyday people. This platform aims to make financial help more readily available, and perhaps even more predictable, which can be a huge comfort for anyone managing their money. It's a fresh take, you know, on an old problem.

How lendli Works: A Smooth Process

When you consider how lendli operates, it’s designed to be quite straightforward, much like a smooth evolution over time. As we know that the evolution is smooth and even mostly linear if looked at over a time frame of a few years, one way of evaluating an algorithm is to look at the smoothness or linearity of the process. lendli tries to apply this same principle to financial interactions, aiming for a process that feels natural and easy to follow for everyone involved.

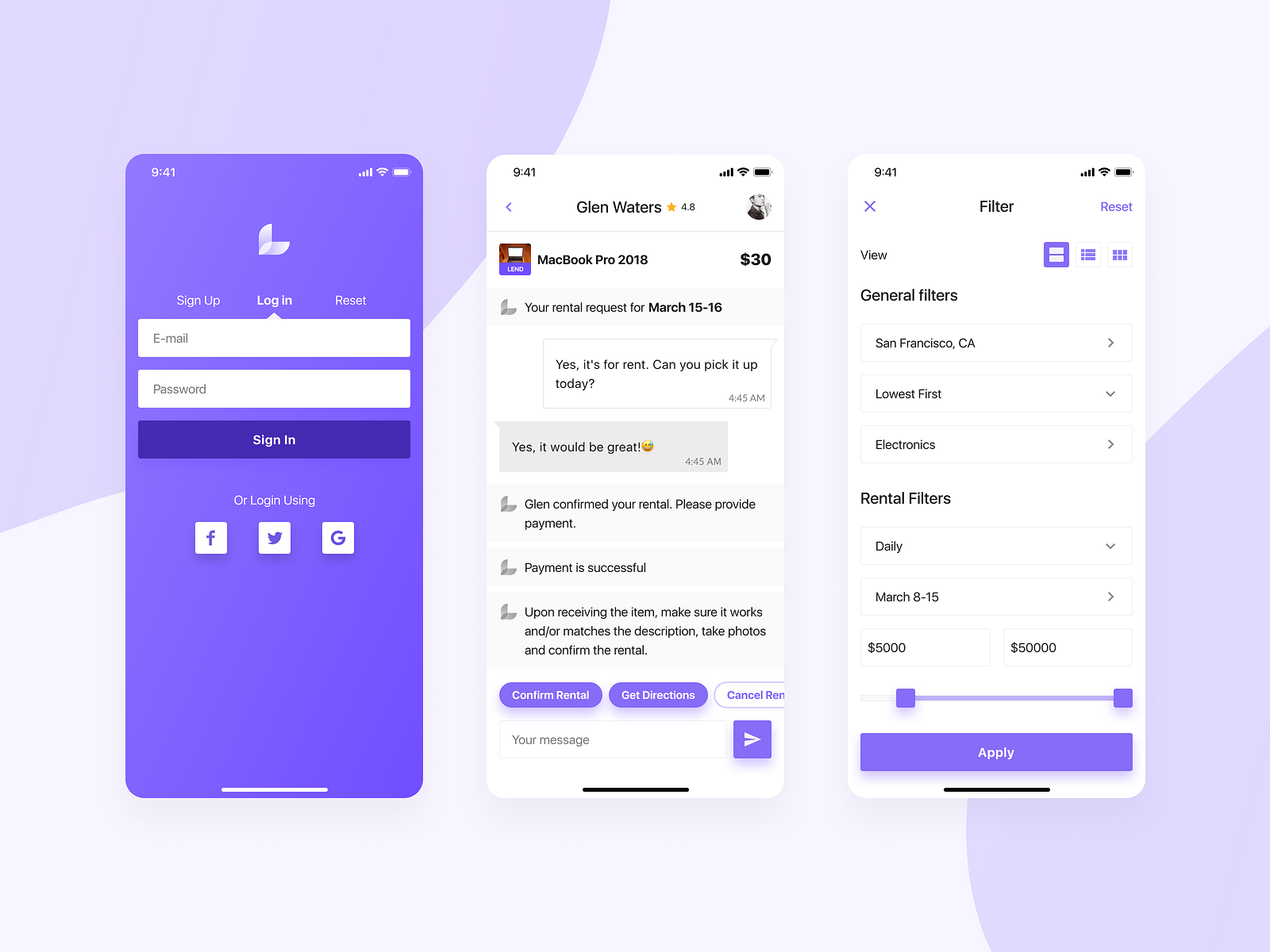

The process typically begins with someone stating their financial need or, conversely, someone offering to provide financial assistance. The platform then works to match these individuals based on various criteria, trying to ensure a good fit. This matching process is, you know, quite important for creating successful connections. It is not just about linking two people; it is about finding compatible needs and offers.

Once a match is made, the platform guides both parties through the necessary steps to finalize their arrangement. This includes clear communication tools and structured agreements, making sure everyone is on the same page. It is all about making the transaction feel as seamless as possible, almost like a well-oiled machine. This focus on clarity and ease is a key part of the lendli experience, as a matter of fact.

For those providing funds, lendli often offers a way to specify their terms, perhaps how much they wish to offer, or over what period. For those receiving funds, they can outline their requirements, like the amount they need and their repayment plan. This flexibility is a big draw for many, as it allows for arrangements that might not be possible through traditional routes. It is, basically, a more customized approach to financial dealings.

The goal is to eliminate unnecessary friction, making the entire journey from request to completion feel very simple. Think of it like measuring the smoothness of a surface; lendli tries to ensure the "surface" of its financial transactions is as polished as can be. This dedication to a user-friendly experience really helps build trust and encourages more people to participate, you know, in this unique financial community.

The Accuracy of lendli: Building Trust

In any financial arrangement, trust is absolutely vital, and a big part of trust comes from accuracy. In deep learning, accuracy curves are crucial for evaluating a model's performance. Typically, an accuracy curve resembles a logarithmic function, showing how performance improves over time. lendli, in a similar way, aims for its accuracy in matching and facilitating connections to steadily grow, making the platform more reliable with each interaction.

The platform uses what could be described as smart systems to assess profiles and needs, working to make the most appropriate connections. This means trying to ensure that those who offer funds are matched with individuals who genuinely fit their criteria, and that those seeking funds are connected with suitable providers. It is, in essence, about getting the right people together, which is pretty fundamental.

Measuring the effectiveness of such a system is somewhat like measuring the smoothness or roughness of a time series. You want to see consistent, predictable outcomes. lendli continuously evaluates its own performance, looking at how well matches are made and how smoothly transactions proceed. This ongoing assessment helps refine the system, leading to better and more dependable results over time, you know, for everyone involved.

For instance, just as a USGA accredited stimpmeter helps measure the smoothness of a golf green, lendli has its own ways of gauging the "smoothness" and reliability of its financial connections. It is about understanding the "surface finish" of each transaction, ensuring that the process feels consistent and fair. This commitment to measuring and improving accuracy helps build a strong foundation of trust among its users, which is very important.

This focus on precision means that users can feel more confident when using lendli. They can expect that the information provided is sound and that the connections made are thoughtful. This constant pursuit of better outcomes helps solidify lendli's standing as a dependable option for financial interactions. It is, essentially, about delivering on its promise of reliable connections, which is what people really look for.

Why lendli Matters for You

lendli matters for a good many reasons, particularly if you are looking for alternatives to traditional financial paths. For many, the conventional ways of borrowing or lending can be quite rigid, or perhaps even inaccessible. lendli offers a fresh breath of air, providing a flexible and community-focused approach that puts people first. It is, arguably, a more human way to handle financial needs, if you think about it.

One key benefit is the potential for more personalized arrangements. Unlike a bank with set rules, lendli allows for a bit more give and take between individuals. This means you might find terms that fit your specific situation better, whether you are looking for a loan or offering one. This flexibility is a really big deal for people who might not fit neatly into standard categories, you know?

Another important aspect is the emphasis on transparency. With lendli, the aim is to make everything clear, from the terms of an agreement to the progress of a transaction. This clarity helps build confidence and reduces surprises, which can be a source of stress in financial matters. It is about making sure everyone knows where they stand, which is pretty reassuring.

Furthermore, lendli taps into the power of community. Just like how Facebook helps you connect with friends, family, and communities of people who share your interests, lendli connects individuals who share a common financial goal. This community aspect can provide a sense of support and shared purpose, making financial interactions feel less transactional and more collaborative. It is, essentially, about building a network of trust.

For anyone who values straightforwardness, flexibility, and a sense of connection in their financial dealings, lendli presents a compelling option. It is about moving towards a future where financial support is more readily available and less complicated, helping individuals achieve their goals with greater ease. This kind of approach, you see, could really make a difference in people's lives.

Comparing lendli: Understanding the Differences

When you look at lendli next to other financial services, you start to see its rather distinct character. Traditional banks, for example, often operate with strict criteria and a more formal structure. lendli, on the other hand, tries to offer a more adaptable and direct connection between individuals, which is a pretty big difference. It is, basically, about simplifying the path from need to solution.

Consider the process. With a bank, you typically fill out extensive paperwork, and decisions are made by institutions based on predefined policies. lendli, conversely, focuses on enabling direct agreements between people. This makes the experience feel more personal and less bureaucratic, which can be a huge relief for many. It is, essentially, a different philosophy at play.

Then there is the matter of community and connection. Traditional finance can feel impersonal, like a series of transactions with a large entity. lendli, however, aims to foster a sense of shared purpose, much like a social platform brings people together. It is about leveraging the power of a connected network to facilitate financial exchanges, which is a unique approach, you know?

While traditional services have their place, lendli offers an alternative that prioritizes user experience and direct interaction. It is not necessarily about replacing existing systems, but rather providing a complementary option for those who seek something different. This distinction is quite important for understanding where lendli fits into the broader financial landscape. It is, essentially, about expanding your choices.

Ultimately, the choice comes down to what you value most in a financial service. If you prefer a more direct, flexible, and community-driven approach, then lendli might be a particularly good fit. It is about finding the right tool for your specific financial needs, and lendli certainly offers a distinct set of advantages for many people, you know, looking for something new.

Getting Started with lendli

Starting with lendli is designed to be a straightforward process, aiming to get you connected without unnecessary delays. Just like creating an account on Facebook, where you can sign up from the app or website, lendli tries to make its entry point as simple as possible. The goal is to remove barriers, letting you begin your financial journey with ease, which is pretty helpful.

Typically, you would begin by visiting the lendli platform, either through its website or a dedicated application, if one is available. There, you will find prompts to create your account. This usually involves providing some basic information to help verify your identity and ensure the security of the community. It is, essentially, about making sure everyone on the platform is who they say they are.

Once your account is set up, you can then explore the features and decide whether you want to offer financial support or seek it. The platform often provides clear guidance on how to navigate these options, helping you understand each step. This guidance is, you know, quite important for new users. You will find tools to help you define your needs or your offerings, making the process clear and manageable.

It is worth taking a little time to familiarize yourself with the platform's guidelines and terms. This helps ensure a smooth experience for everyone involved and helps you make the most of what lendli has to offer. Just like understanding how to measure smoothness or roughness of a time series helps you interpret data, understanding lendli's rules helps you use it effectively. This initial step is, basically, about setting yourself up for success.

So, whether you are ready to make a financial connection or just curious to explore the possibilities, getting started with lendli is typically a simple and guided process. It is about opening up new avenues for financial interaction, and the platform tries to make that first step as welcoming as possible. You can learn more about lendli on our site, and also find additional resources on financial connections to help you get started.

Frequently Asked Questions About lendli

What makes lendli different from traditional banks?

lendli really focuses on direct, peer-to-peer connections, which is pretty different from traditional banks. Banks typically operate with established rules and a more formal structure, while lendli aims to provide a more flexible and community-driven approach. It is, essentially, about empowering individuals to connect directly for financial needs, cutting out some of the usual intermediaries, you know?

How does lendli ensure the safety of financial interactions?

Safety is a very big concern for lendli, and it tries to ensure interactions are secure through various measures. This often includes identity verification processes for users and clear agreement structures. The platform also works to maintain transparency, so both parties understand the terms. It is, basically, about building a trustworthy environment, much like a well-regulated system, if you will.

Can anyone use lendli, or are there specific requirements?

Generally, lendli aims to be accessible to a wide range of individuals, but there are usually some specific requirements to ensure the integrity of the platform. These might include age limits or residency requirements, and perhaps some basic financial checks. The goal is to make it as open as possible while maintaining a secure and reliable community for all users, which is pretty important, you know?

The Future of Financial Connections with lendli

The future of financial connections, particularly with platforms like lendli, seems to be moving towards greater directness and community involvement. As people look for more personalized and less bureaucratic ways to manage their money, lendli offers a glimpse into what that future could look like. It is, essentially, about making financial interactions feel more human and less like a cold transaction, which is a pretty exciting prospect.

The continued focus on accuracy and smoothness in its operations will be key for lendli's growth. Just as accuracy curves show improvement over time, lendli's ability to consistently deliver reliable and straightforward connections will help it gain more trust. This commitment to quality and user experience is what truly sets it apart and could help it become a significant player in the financial landscape, you know?

Imagine a world where getting financial support, or offering it, is as simple as connecting with someone who shares your interest, much like how Facebook connects people with shared hobbies. lendli is working towards that vision, creating a network where financial needs can be met with greater ease and understanding. It is, basically, about building a more connected and supportive financial ecosystem for everyone.

As financial technologies continue to evolve, platforms that prioritize transparency, flexibility, and community will likely see increasing adoption. lendli is certainly positioned to be a part of this shift, offering a compelling alternative for those seeking a fresh approach to their financial lives. It is, ultimately, about empowering individuals and fostering a sense of mutual support, which is a truly valuable endeavor in today's world.

- Is Raven A Real Name

- Cinnamon Toast Ken Age

- Kaitlan Collins Married Will Douglas

- Patrick Kilpatrick Net Worth

- Nicholas Jones Actor Wife

Lendli

Lendli - Full Project on Behance

Lendli App Design by khutornyi roman on Dribbble