What Is Withholding Tax Everfi: Making Sense Of Your Paycheck

Ever wonder what happens to a chunk of your hard-earned money before it even hits your bank account? You're certainly not alone, so many people ask about this. It's a common question for anyone just starting out in the working world or, you know, just trying to get a better handle on their finances. This is where the idea of "withholding tax" comes into play, and it's a pretty big deal for most folks with a job.

Learning about income tax withholding and estimated tax payments is, in a way, like getting a secret decoder ring for your pay stub. It helps you see where your money goes and why. For a lot of people, especially those using resources like Everfi to learn about money, getting this part right can make a huge difference in how they feel about their financial picture, actually.

This article will help explain what withholding tax is, why your employer takes it out, and how you can make sure the right amount is being held back. We'll talk about how you can even change it if you need to, because that's a thing you can do. Getting a grip on this part of your money life is, pretty much, a smart move for everyone.

- Who Was Married To Patrick Swayze

- Is Emily Compagno Married

- Sandra Smith Husband

- Shaq Dad

- Luis Fonsi Networth

Table of Contents

- What is Withholding Tax?

- How Withholding Works on Your Paycheck

- Making Sure the Correct Amount is Withheld

- Why Understanding Withholding Matters

- Common Questions About Withholding Tax

What is Withholding Tax?

So, what exactly is this "withholding tax" we're talking about? It's basically a portion of the money you earn from your job that your employer takes out of your paycheck. This money isn't just kept by your employer, you know. Instead, they send it directly to the government's tax people, like the IRS, on your behalf. It's a way of paying some of your income taxes throughout the year, rather than all at once when tax season rolls around.

Think of it as a little bit of your income tax being paid ahead of time. It's a system designed to help you avoid a huge tax bill at the end of the year, which, let's be honest, would be a pretty big shock for most people. This system helps keep things a bit smoother for everyone involved, the government and the taxpayer, actually.

The whole idea behind it is to make tax collection more consistent. For both employees and employers, getting a handle on this concept is, you know, pretty important. It affects what shows up in your bank account, and it affects how businesses manage their payroll duties, too.

- How To Get Static Out Of Clothes Quickly

- Who Played Ally Barone

- Kissa Sins

- Teach Me First Manwa

- Giphy Happy Birthday Funny

The Meaning of "Withhold"

The word "withhold" itself gives us a big clue about what's happening. When you hear words like "keep," "retain," or "reserve," they all suggest holding onto something. In this case, it means your employer holds back a part of your earnings. They're not keeping it for themselves, of course, but rather holding it securely for its intended purpose: paying your taxes.

It's about having control over a portion of something. Your employer has control over a part of your wages for a short time. Then, they pass that control, and that money, over to the government. It's a pretty direct way of handling a financial responsibility, you see.

This action of holding back a part of your pay is a standard practice for almost all jobs. It’s a key part of how our tax system operates, ensuring that tax payments are made regularly, which, you know, helps the government run its programs.

Why Employers Withhold Your Money

Employers take out withholding tax because it's their job, basically. The government requires them to do it. It's a legal duty for businesses that pay wages to people. This system helps ensure that tax revenue comes in steadily throughout the year, which is, you know, pretty vital for government operations.

For you, the employee, it means you don't have to worry about saving up a huge amount of money to pay your taxes all at once. Instead, smaller amounts are taken out regularly. This can make budgeting a lot easier for many people, which is a good thing, really.

It also simplifies things for the government, as they get estimated tax payments consistently from millions of workers. This method helps prevent a situation where everyone owes a massive sum at tax time, which could be, you know, quite chaotic.

Federal vs. State Withholding

When we talk about withholding tax, we're usually thinking about federal income tax. This is the money your employer sends to the IRS, the national tax agency. However, many states also have their own income taxes, and your employer might withhold money for those too. So, you could see deductions for both federal and state taxes on your pay stub, actually.

The rules for state withholding can be different from state to state, so it's worth knowing what applies where you live and work. Some states don't even have income tax, which means no state withholding in those places, you know. Others have different rates and rules.

It’s important to understand that these are separate taxes, even though they both come out of your paycheck. Your federal withholding goes to the national government, while state withholding goes to your state government. They both serve the same purpose, which is to prepay your income taxes, but for different levels of government, you see.

How Withholding Works on Your Paycheck

So, how does this whole withholding thing actually play out on your paycheck? It's not just a random amount. The money that's held back is calculated based on some information you provide and rules set by the government. This calculation helps determine how much of your pay gets sent off to the tax authorities. It's a pretty specific process, you know.

Each time you get paid, a portion of your wages is set aside. This is done automatically by your employer's payroll system. It's designed to be a smooth process, so you don't have to think about making those payments yourself every pay period, which is, you know, a bit of a relief for many.

The goal is to get as close as possible to the total amount of income tax you'll owe for the year. It's like making small, regular deposits into a tax account, so that when the big bill comes, you've already covered most of it, or even all of it, actually.

Your W-4 Form and What It Does

When you start a new job, one of the first things you fill out is a form called a W-4. This form is super important because it tells your employer how much federal income tax to hold back from your pay. It helps determine how much money is withheld. You provide information about your household, like if you're single or married, if you have dependents, or if you have other jobs.

The W-4 form has changed over the years to make it a bit simpler, but its purpose remains the same: to help you and your employer figure out the right amount of tax to withhold. If you don't fill it out, your employer will usually withhold at the highest rate, which means more money taken out, which, you know, might not be what you want.

It's worth taking a moment to fill out your W-4 carefully. The more accurate your information, the better chance you have of having the correct amount of tax withheld. This form is, basically, your way of communicating your tax situation to your employer for withholding purposes.

A Prepayment on Your Taxes

The most important thing to remember about withholding tax is that it's essentially a prepayment on the income taxes you'll owe for the year. It's not an extra tax; it's just a way of paying your existing tax bill in smaller chunks throughout the year. Think of it like paying a subscription service monthly instead of one big annual fee, you know.

This prepayment method is helpful because it spreads out your tax burden. Instead of facing a huge bill on April 15th, you've already covered a good portion, if not all, of what you owe. This can really help with personal budgeting and avoiding financial stress, which is, you know, a pretty good thing.

For the government, it means a steady flow of income. For you, it means less sticker shock when you file your tax return. It’s a system that benefits both sides, really, by making tax collection and payment more manageable for everyone involved, actually.

What Happens if Too Much is Withheld?

If your employer holds back too much money from your pay throughout the year, you'll generally receive a tax refund. This means the government owes you money because you've overpaid your estimated taxes. Getting a refund can feel pretty good, like a bonus, you know.

However, getting a large refund also means you essentially gave the government an interest-free loan throughout the year. That money could have been in your pocket, earning interest or being used for other things. So, while a refund is nice, it often means your withholding wasn't perfectly aligned with what you actually owed, actually.

Many people like getting a refund, and that's fine. But if you prefer to have more money in each paycheck and less come back as a refund, you might want to adjust your withholding. It's all about finding the balance that works best for your personal financial situation, you know.

What Happens if Too Little is Withheld?

On the flip side, if your employer holds back too little money from your pay, you'll likely owe money when you file your tax return. This can be a bit of a surprise, and not a good one, for some people. You might even have to pay penalties if you owe a lot and haven't paid enough through withholding or estimated payments.

Owing money means you didn't prepay enough of your taxes during the year. This can happen if your income changes, or if your W-4 form isn't set up correctly for your situation. It's a common issue for people who have multiple jobs or significant income from other sources, actually.

To avoid this, it's a good idea to check your withholding periodically, especially if your life circumstances change. Making sure enough is withheld can save you from a big tax bill and potential penalties down the road, which is, you know, something most people want to avoid.

Making Sure the Correct Amount is Withheld

Getting your withholding amount just right is, basically, a sweet spot. You want to avoid owing a lot at tax time, but you also don't want to give the government an interest-free loan by overpaying. There are a few simple steps you can take to check and adjust your withholding to make sure it's pretty much on target.

This isn't a "set it and forget it" kind of thing for everyone. Life changes, and your tax situation often changes with it. So, a little check-in now and then can really help keep things aligned. It's about being proactive with your money, you know.

Taking control of your withholding can give you more peace of mind about your taxes. It means fewer surprises and a better handle on your overall financial picture, which is, you know, a pretty good feeling to have, actually.

Reviewing Your Pay Stubs

Your pay stub is a valuable piece of paper, or digital document, that tells you a lot about your money. It shows how much you earned, and crucially, how much was taken out for taxes and other things. Take a moment to look at the "Federal Withholding" or "FIT" amount on your stub. This is the money being sent to the IRS on your behalf, actually.

Checking your pay stub regularly helps you see if the amount being withheld seems reasonable for your income. If you notice a big change you didn't expect, or if it just feels off, that's a sign to look into it. It's your money, after all, so knowing where it goes is, you know, pretty important.

Some people like to do a quick calculation to estimate their annual tax liability and compare it to their year-to-date withholding. This can give you a rough idea if you're on track. It's a simple habit that can prevent bigger issues later, you see.

Life Changes and Your Withholding

Life has a funny way of changing things, and those changes often affect your tax situation. Getting married, having a baby, buying a house, or even taking on a second job can all mean you need to adjust your withholding. These events can change your deductions or credits, which then changes how much tax you owe, actually.

For example, if you get married, your household income might increase, or your filing status changes. If you have a child, you might qualify for new tax credits. These things mean your W-4 form might need an update to reflect your new reality. It's like updating your GPS when you move to a new address, you know.

It's a good habit to review your W-4 whenever a big life event happens. Doing so can help prevent surprises at tax time, whether that's a huge bill or a much smaller refund than you expected. Staying on top of these changes is, basically, smart money management.

How to Change Your Withholding

If you decide you need to adjust the amount of tax withheld from your paycheck, it's pretty straightforward. You just need to fill out a new W-4 form and give it to your employer. They will then update their records and start withholding the new amount from your next pay period, or soon after, you know.

The IRS website has a handy Tax Withholding Estimator tool that can help you figure out how to fill out your W-4. It asks you a few questions about your income, deductions, and credits, and then suggests how you should complete the form. It's a really helpful resource for getting it right, actually.

You can change your W-4 as many times as you need to throughout the year. If you find you're still getting too big a refund or owing too much, just fill out another one. It's all about fine-tuning it until it feels right for your financial comfort, you see. Learn more about income tax on our site, and also find details about personal finance planning.

Why Understanding Withholding Matters

Understanding the concept of withholding taxes is, to be honest, pretty crucial for both employees and employers. For employees, it means you know what's happening with your money before it even reaches your pocket. It helps you budget better and avoid surprises when tax season rolls around. Knowing this stuff empowers you to make better financial choices, actually.

For employers, it's about fulfilling their legal duties and ensuring their payroll is handled correctly. Incorrect withholding can lead to problems for both the business and its employees. So, getting it right from the start is, you know, pretty important for smooth operations.

This knowledge also helps you talk more confidently with financial advisors or tax professionals. You'll be able to ask better questions and understand their advice more clearly. It's a foundational piece of financial literacy that benefits everyone who earns a wage, you see. For more detailed information, you can always check out resources like the IRS website.

Common Questions About Withholding Tax

What is the purpose of withholding tax?

The main purpose of withholding tax is to collect income taxes gradually throughout the year, rather than all at once. It acts as a prepayment on your yearly tax bill. This system helps prevent people from having a huge tax debt at the end of the year, which could be, you know, a big burden. It also provides a steady flow of funds for government operations, actually.

How do I know if I'm withholding too much or too little?

You can tell if you're withholding too much or too little by looking at your tax refund or tax bill when you file your annual tax return. If you get a very large refund, you're probably withholding too much. If you owe a lot of money, or even have to pay penalties, you're likely withholding too little. The IRS Tax Withholding Estimator tool is also a great way to check your current situation and adjust, you know.

What form is used to adjust withholding?

To adjust your income tax withholding, you use the Form W-4, also known as the "Employee's Withholding Certificate." You fill out this form and give it to your employer. This form helps determine how much federal income tax should be taken from your paycheck. You can update it any time your financial or family situation changes, actually.

- Tiger Woods Net Worth In Usd

- Celibate Meaning

- Overtime Megan Leaked Erome

- Pickle Sandwich

- Alison Krauss Net Worth

Scholarship Contest - EVERFI | TurboTax

What is Tax Withholding? All Your Questions Answered by Napkin Finance

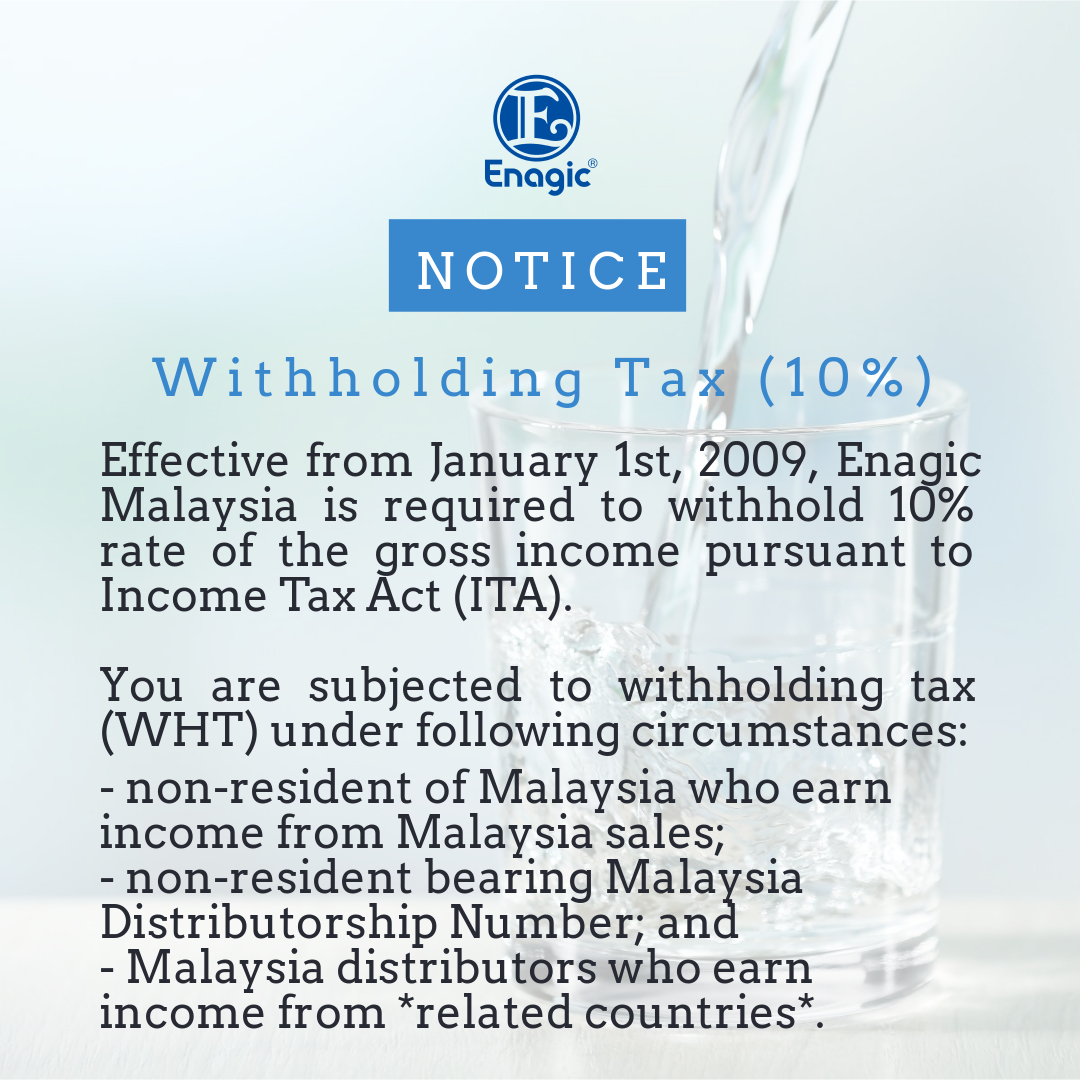

NOTICE | Withholding Tax (10%) - Enagic (Malaysia) Sdn Bhd